The Evolution and Impact of Property Taxes: A Comparative Analysis

Early property taxes, first introduced during feudal times, were primarily imposed on land and largely paid by farmers. In contemporary settings, property taxes encompass assets like real estate and are levied on a recurrent basis from individuals and legal entities.

Impacts of High Property Taxes on Investment and Business Localization

Elevated property taxes, which apply not only to land but also to buildings and structures, can deter investment in infrastructure. This results in additional mandatory payments or charges collected by local, state, and national governments to cover the costs of general services, goods, and activities. Consequently, businesses may choose to locate away from areas with high property taxes to avoid these additional costs.

Property Tax Policies Across Europe

Among the 29 European countries examined, Liechtenstein and Malta stand out, as they do not impose any recurrent taxes on property. Estonia is unique in this region, taxing only land, thus making its property tax system particularly efficient.

Corporate Deductions and Investment Encouragement

Out of the 27 European countries that levy property taxes, 23 allow businesses to deduct these taxes from their corporate income. This mitigation of the tax burden encourages business investment.

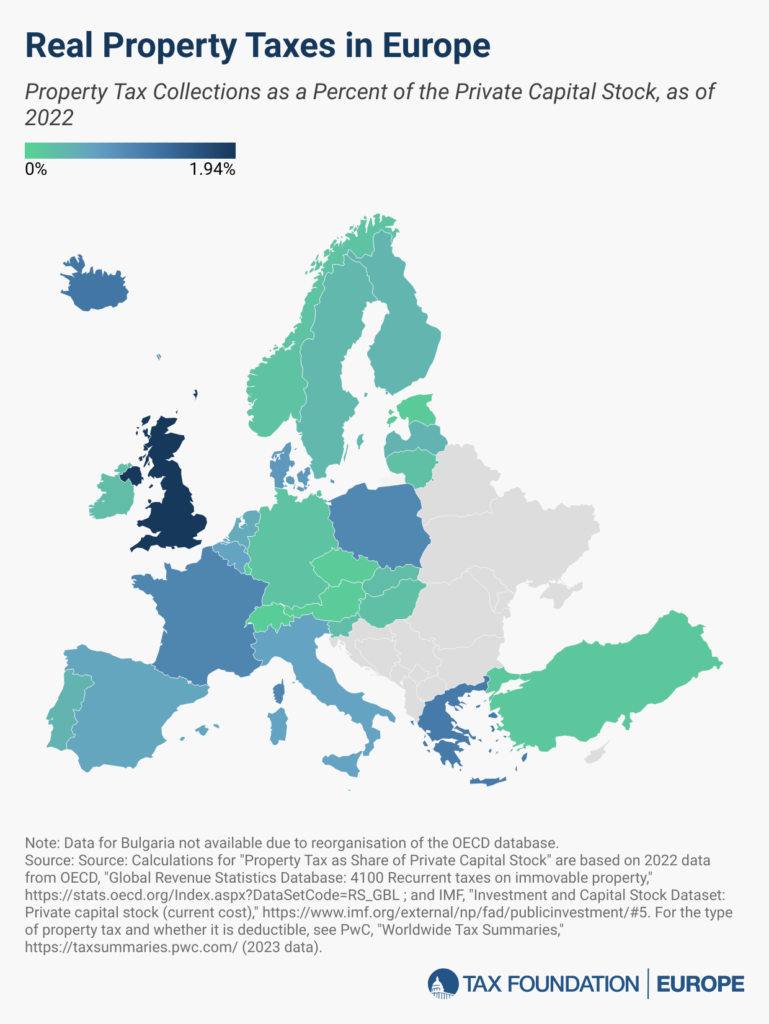

Comparative Property Tax Revenue

Luxembourg reports the lowest property tax revenue as a percentage of private capital stock at 0.05 percent, followed closely by Switzerland at 0.08 percent, and the Czech Republic at 0.1 percent. Conversely, the highest property taxes relative to private capital stock are found in the United Kingdom (1.94 percent), Iceland (1.18 percent), and Greece (1.13 percent).

Average Property Tax Revenue in Europe vs. the United States

On average, the revenue from recurrent property taxes in the 29 European countries is 0.45 percent of their private capital stocks. By contrast, the United States raises a significant 1.8 percent of its private capital stock in property taxes.

In conclusion, the evolution of property taxes from feudal times to the modern era has seen a shift from a narrow land-based levy to an inclusive asset-based system. While higher property taxes can dissuade infrastructure investment and influence business location decisions, policies allowing deductions help alleviate tax burdens. Comparing international approaches reveals varied efficiencies and impacts, with the U.S. notably raising a higher percentage of property tax revenue from its private capital stock. Explore our website for more insights into international tax policies and their economic implications.