Maximizing Bitcoin Profits by Analyzing ETF Data

The introduction of Bitcoin Exchange Traded Funds (ETFs) in early 2024 has propelled Bitcoin to new record highs, showcasing months of significant gains. While Bitcoin’s performance is impressive on its own, utilizing ETF data can lead to even greater returns.

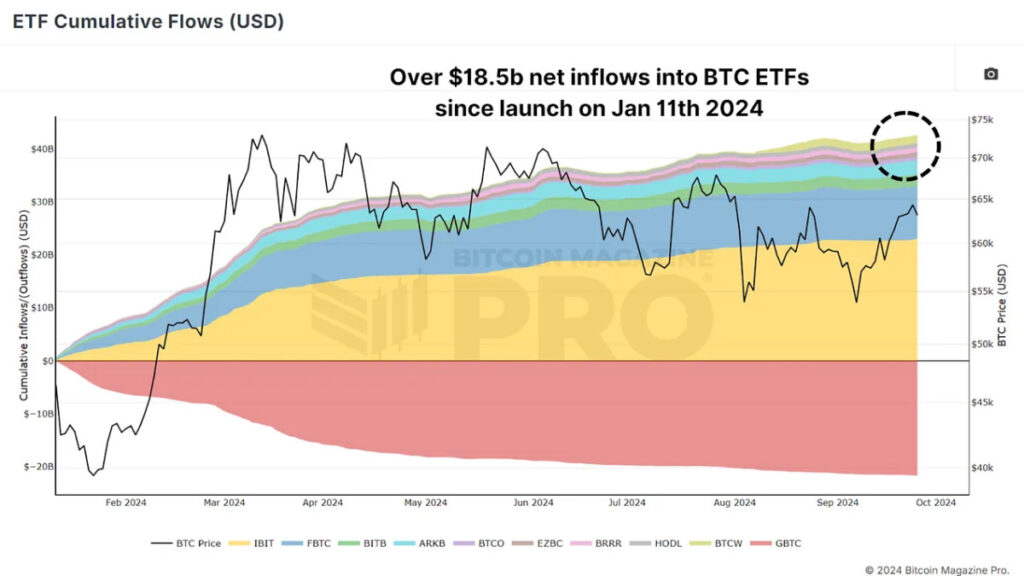

The Impact of Bitcoin ETFs

Launched in January 2024, Bitcoin ETFs have attracted substantial amounts of Bitcoin, offering institutional and retail investors exposure to Bitcoin without direct ownership. These ETFs have accumulated billions of USD worth of BTC, making it crucial to monitor cumulative flows to track institutional activity in Bitcoin markets.

Strategic Trading Decisions Using ETF Data

Monitoring ETF daily inflows and outflows denominated in BTC can provide insights into institutional buying and selling trends. By leveraging this data, traders can strategically time their entry and exit points in Bitcoin trades, potentially outperforming the market during bullish periods.

A Simple Trading Strategy with ETF Data

A straightforward strategy involves buying Bitcoin during positive ETF inflows (green bars) and selling during outflows (red bars). This approach has consistently outperformed the broader Bitcoin market by capturing price momentum and aligning with institutional trends.

Harnessing the Power of Compounding

Compounding gains over time significantly boosts returns, even during periods of consolidation or minor volatility. This compounded strategy has yielded over 100% returns since the launch of Bitcoin ETFs, surpassing traditional buy-and-hold approaches.

Anticipating Further Upside

Recent trends of positive ETF inflows suggest continued institutional accumulation of Bitcoin. This sustained momentum, illustrated by significant inflows and notable institutional activity, could signal further price rallies in the future.

In Summary

Utilizing ETF data to inform trading decisions can be a game-changer for investors seeking to maximize Bitcoin gains. While buy-and-hold strategies remain viable, actively leveraging institutional data from ETFs offers a dynamic approach to enhancing returns in the ever-evolving crypto market.

For more insights on this topic, watch a comprehensive YouTube video on "Using ETF Data to Outperform Bitcoin [Must Watch]." Stay informed, stay engaged, and seize the opportunities presented by Bitcoin ETF data for optimized investment outcomes.