Optimizing Your Excess CPF Savings: Strategies for individuals aged 55 and over

As we approach the closure of CPF Special Account (SA) in early 2025 for individuals aged 55 and over, exploring the options for excess funds in CPF Ordinary Account (OA) becomes crucial. While not personally facing this situation yet, the following information aims to provide valuable insights for those who are.

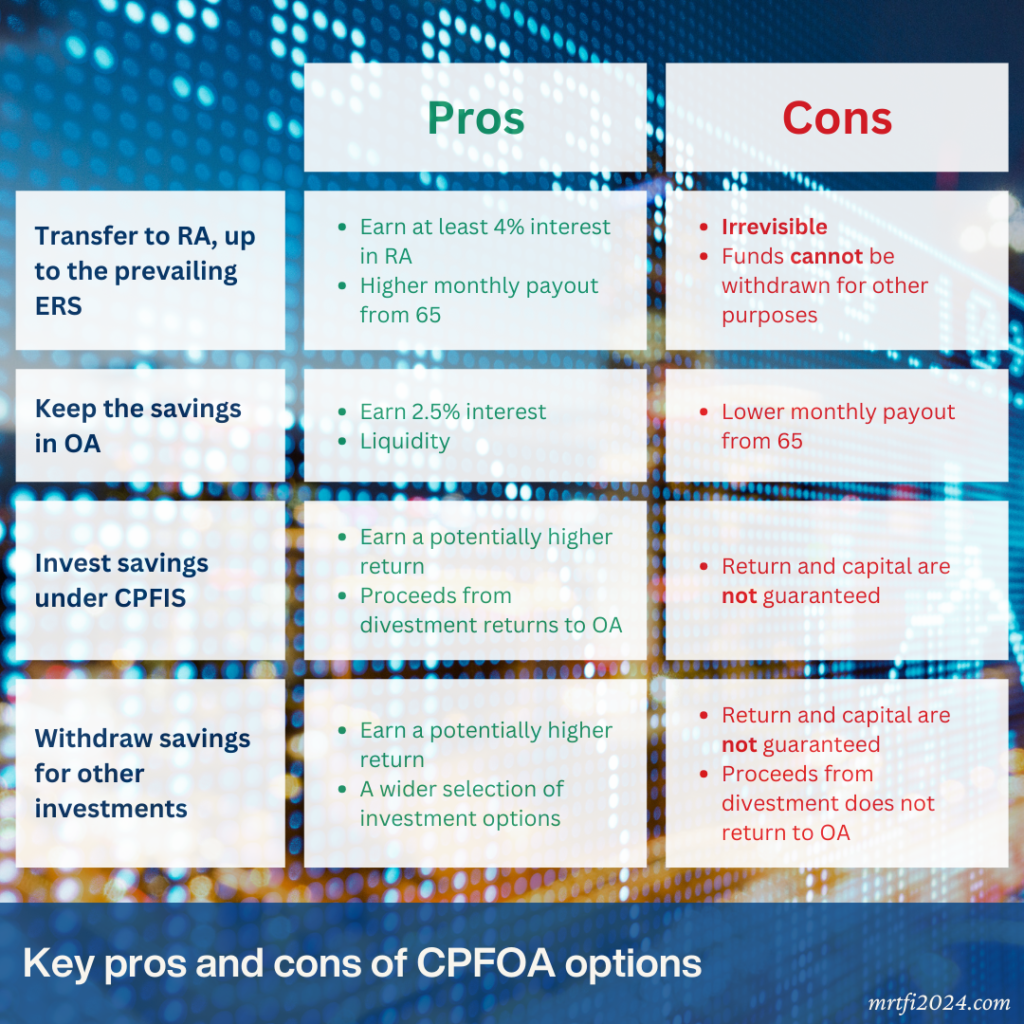

Understanding the primary advantages and disadvantages of various options is essential. Let’s delve into the possibilities:

Option 1: Transfer to CPF Retirement Account (RA) – Enhanced Retirement Sum (ERS)

Transferring funds to RA offers a minimum guaranteed 4% interest rate*, leading to higher monthly payouts from age 65. Factors to consider include irreversibility and potential policy changes.

Option 2: Keep savings in OA

By maintaining savings in OA, you earn a 2.5% interest rate per annum and retain liquidity. You can use OA funds to supplement CPF Life payouts from age 65.

Option 3: Invest under CPF Investment Scheme (CPFIS)

Consider investing OA savings for potential returns exceeding 2.5%. Explore options like Singapore Treasury bills (T-bills), bonds, or ETFs approved by CPFIS.

Option 4: Withdraw for investments outside CPFIS

Invest in instruments like Singapore Savings Bonds (SSB) or explore other options such as US or World ETFs. Unlike CPFIS investments, returns from these investments won’t return to OA.

No Model Answer: Combining options for a customized strategy is key. Tailor your approach to your specific needs and circumstances. Financial planning extends beyond CPF, encompassing asset allocation and individual goals.

For more insights and personalized plans, subscribe for the latest updates from Towards Financial Independence. Plan wisely and adapt your strategy as needed to achieve financial independence.