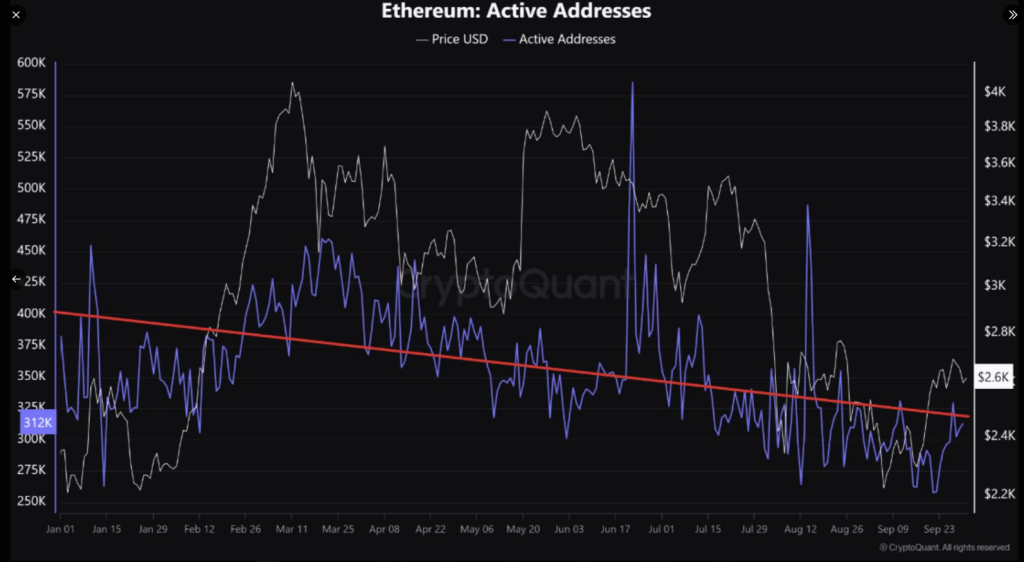

The decline in the cryptocurrency market is evident as both Bitcoin and Ethereum are witnessing a significant decrease in active addresses. Throughout 2024, this downward trend has raised concerns about the future of these top cryptocurrencies and could have far-reaching implications for market dynamics with waning investor enthusiasm.

Explore Further

Diminishing Active Addresses

Data from CryptoQuant reveals that Bitcoin’s active addresses have dropped by 1.17 million to 855,000, while Ethereum has declined by 382,000 to 312,000, translating to a 27% decrease for Bitcoin and an 18% decrease for Ethereum this year.

The primary reason for this decline appears to be the lack of new investors entering the market, crucial for sustaining positive momentum as existing participants drive trading activities without new capital inflows.

Bitcoin and Ethereum addresses have been on the decline since early 2024

“For the bulls to dominate the market, the influx of new investors is a crucial condition.

1. Bitcoin 1.17M -> 855K

2. Ethereum 382K -> 312K” – By @burak_kesmeciFull post 👇https://t.co/gZftQidnxa pic.twitter.com/q5cdpv7x6t

— CryptoQuant.com (@cryptoquant_com) October 1, 2024

Despite anticipations around the approval of spot ETFs, the blockchain activity has not increased significantly. However, the current investor base includes many who would have expected such advancements, amid ongoing liquidity challenges due to the Federal Reserve’s actions.

Market Sentiment And Future Outlook

There are signals pointing towards a potential rebound despite the current challenges. The positive funding rate on Ethereum indicates growing investor interest in long positions, suggesting market optimism even amidst Ethereum price declines.

BTC and ETH addresses decline: BTC drops to 855K, ETH to 312K in 2024

Since the start of 2024, the number of active Bitcoin and Ethereum addresses has continued to drop. Bitcoin addresses fell from 1.17 million to 855,000, while Ethereum addresses declined from 382,000 to…

— CoinNess Global (@CoinnessGL) October 1, 2024

Notably, major Ethereum holders have been accumulating their assets rather than selling, indicating confidence in the altcoin’s future. Such actions often precede price recoveries.

Moreover, Bitcoin’s Exchange Flow Multiple has dropped significantly, implying that investors are holding assets in anticipation of future price increments rather than engaging in active trading.

Keep Exploring

Bitcoin & Ethereum: Strategic Insights

The broader cryptocurrency market is navigating a complex landscape shaped by geopolitical factors and regulatory changes, prompting investors to exercise caution. Despite Ethereum’s price drop to around $2,390 amid market volatility, Bitcoin has maintained stability above $61,100.

Featured image from Vecteezy, chart from TradingView