Heading into the final quarter of 2024, Bitcoin investors are eagerly anticipating a potential rally. Historical data suggests that Q4 often brings positive price action for Bitcoin, with strong performances in previous years. Let’s delve into the historical analysis, trends, and possibilities of what BTC’s price action may look like by the end of this year.

Exploring Bitcoin’s Past Performance in Q4

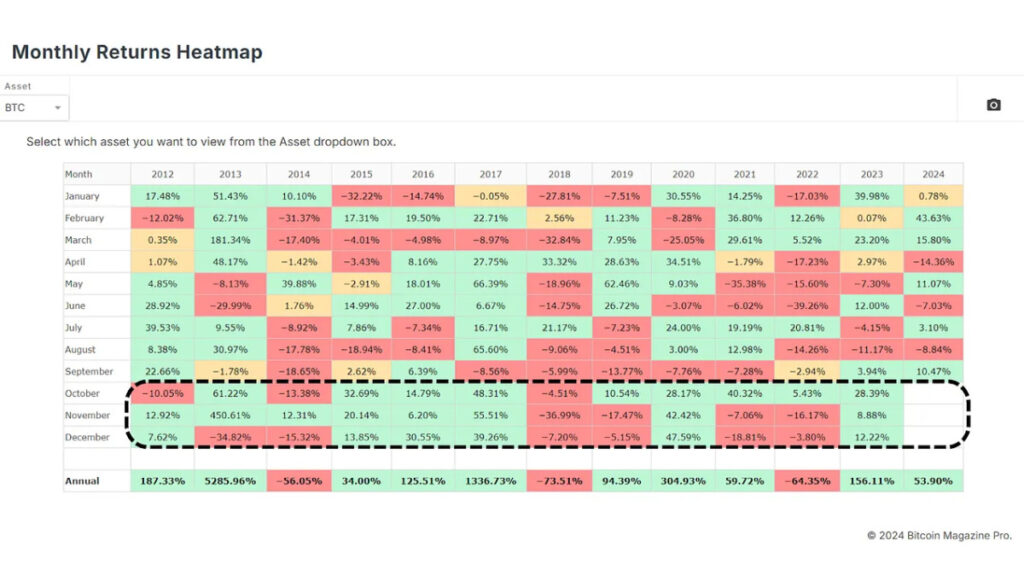

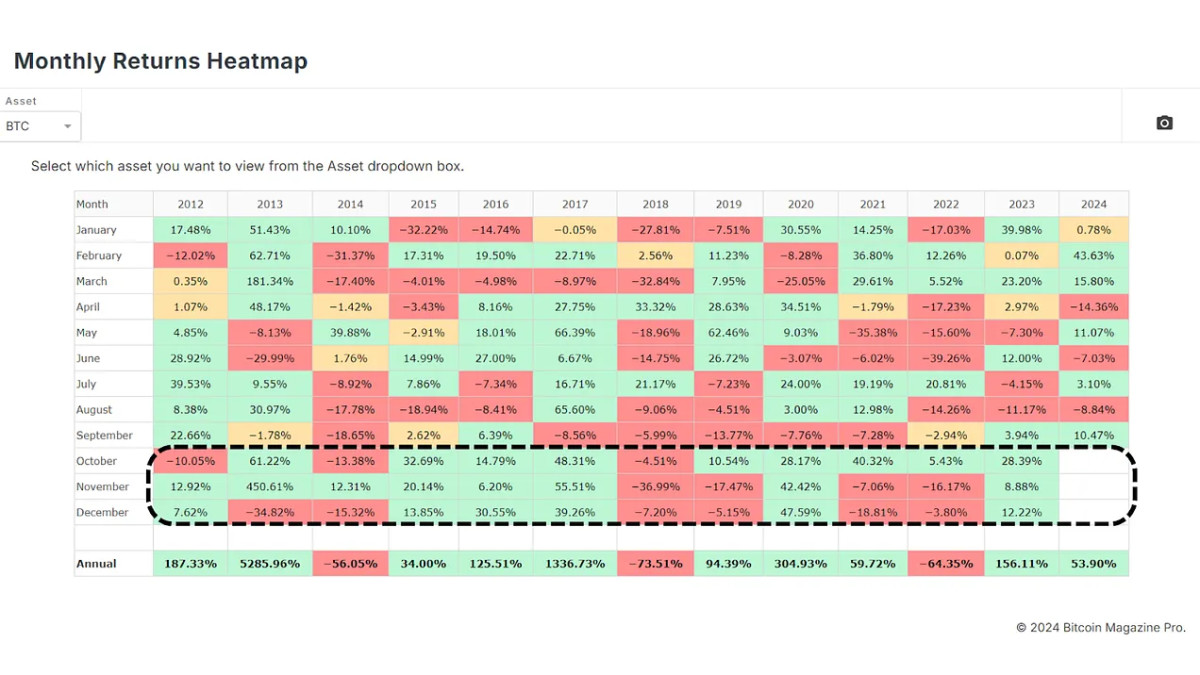

Looking back over the past decade using the Monthly Returns Heatmap, it’s clear that Q4 has been a period of impressive gains for Bitcoin. Although not every year follows the same trend, with some ending on a bearish note like 2021 and 2022, others have seen significant price surges such as in 2020 and 2015-2017. This historical data indicates the potential for a bullish finish in Q4.

Analyzing Potential Q4 2024 Outcomes Based on Historical Data

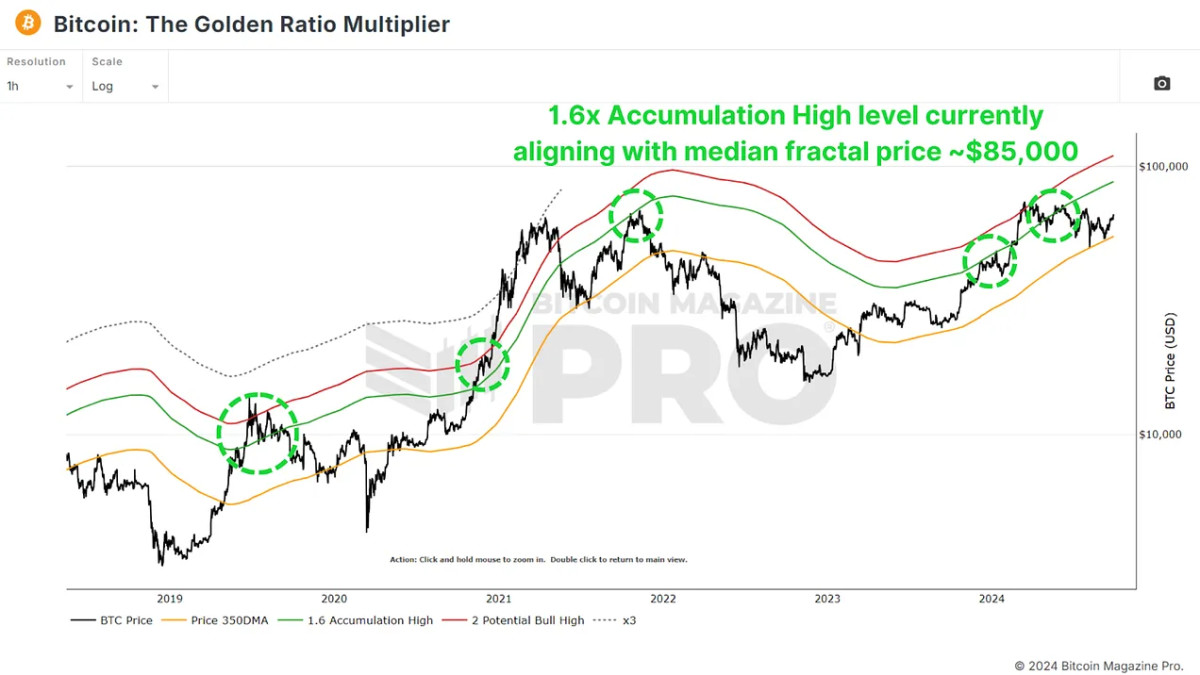

Comparing past Q4 performances to current price action can provide insights into potential outcomes for Q4 2024. The range of possibilities is vast, from significant gains to minor losses or sideways movement. Historical patterns suggest a median outcome around the $85,000 price point, although more optimistic scenarios could see BTC reach as high as $240,000 by the end of the year.

While a $85,000 price target for Bitcoin in Q4 may seem optimistic, recent trends and metrics like The Golden Ratio Multiplier show confluence around this level as a potential target.

Examining the Possibility of $240,000

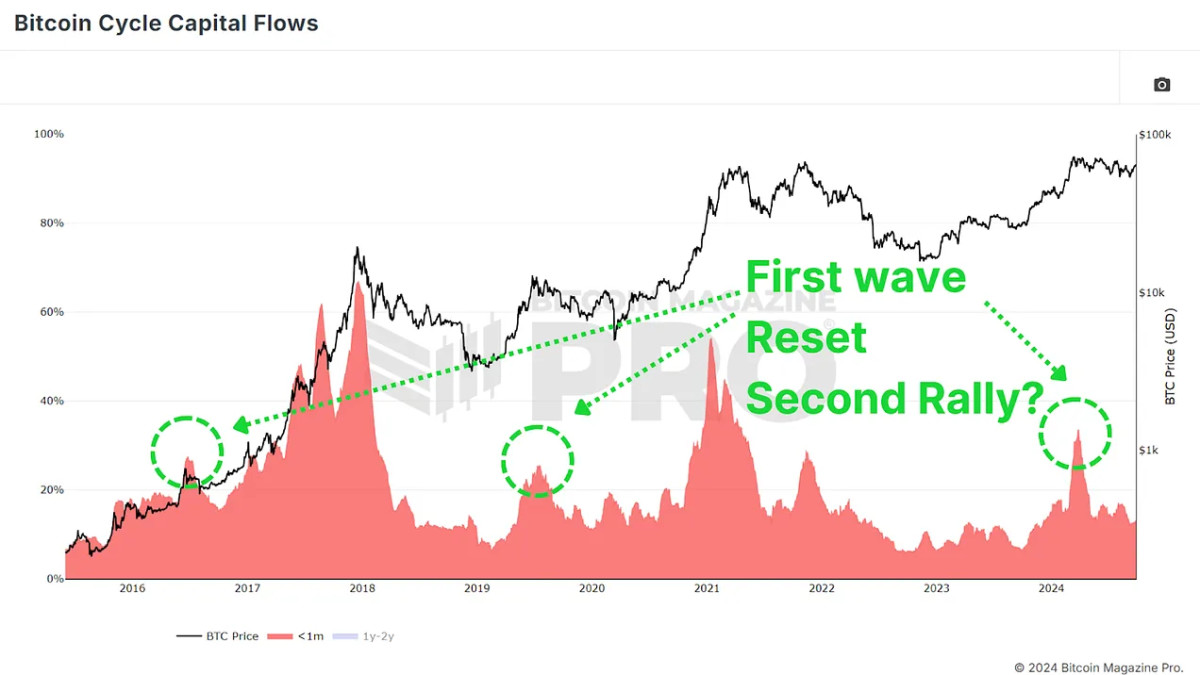

Whether Bitcoin can reach such high values in Q4 depends on various factors like demand, supply, institutional investments, and major events. While $240,000 may be ambitious, recent market trends and patterns suggest a potential for further growth. The cycle capital flows indicate a similar run-up and cool-off period to prior cycles, potentially setting the stage for a second rally.

While the $240,000 target might be ambitious, with Bitcoin, nothing is impossible. It’s essential for investors to remain objective and react to Bitcoin data and price action rather than trying to predict it.

Conclusion

As we approach Q4, optimism surrounds Bitcoin’s potential performance, based on historical data. While the future is always uncertain, investors should stay informed, adaptable, and open to possibilities. It’s crucial to stay engaged with the market and make informed decisions. For more insights, watch our recent YouTube video on Bitcoin Q4 – A Positive End To 2024?

.