Investor Portfolio Performance: A Macro Boost from the Fed’s Rate Cut

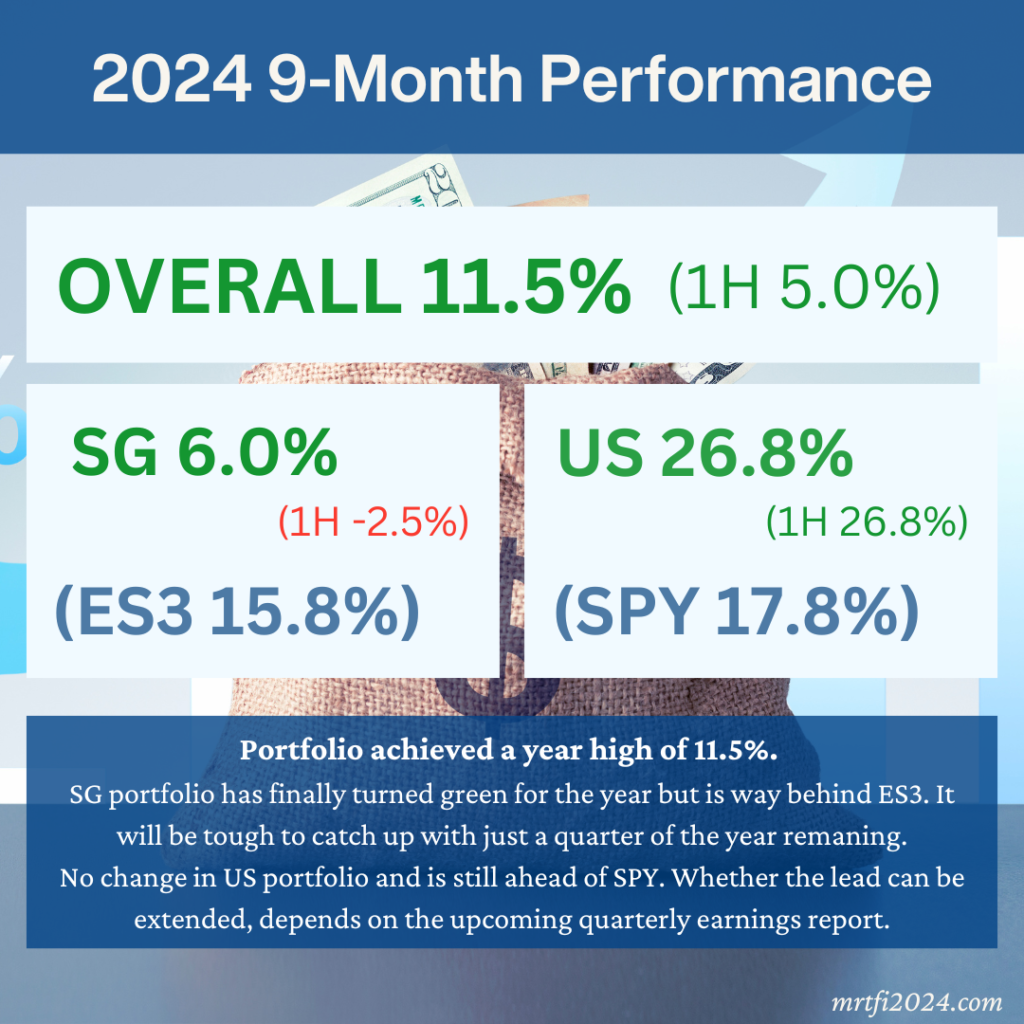

As a bottom-up investor focused on long-term prospects, my portfolio has recently experienced a significant uptick thanks to a macro decision. The Fed’s rate cut has propelled my portfolio to a strong return, boasting a year-to-date return of 11.5%. This positive turnaround can be attributed to the boost in returns from REITs and Banks counters following the rate cut.

The increased yield spread between these stocks and safer investments like Singapore Savings Bonds and T-bills has attracted investor interest. Despite this turnaround, my portfolio continues to lag behind the SPDR Straits Times Index ETF, with the gap widening. Unless there are significant changes in the last quarter, it is likely to underperform the benchmark this year.

On the other hand, my US portfolio is performing well, outpacing the S&P 500 ETF, despite recent fluctuations due to the strengthening Singapore Dollar. However, given its volatility compared to the SPY, sustained outperformance for the remainder of the year is uncertain.

YTD Dividends Double in 5 years

The cumulative dividends in my portfolio have doubled in the past five years. However, this growth is temporary as lower dividends are expected in the next quarter due to the sale of Micro-Mechanics Holdings Ltd shares and a decrease in the company’s dividend payouts. The hope is for a potential recovery in the semiconductor industry next year to boost dividends.

Top and Bottom 5 Performers

While the ranking of top and bottom performers doesn’t indicate long-term business quality, it is still insightful. The top performers include companies like Arista Networks and ParkwayLife REIT, contributing significantly to the portfolio’s success. On the other hand, laggards like iFAST Corporation Limited and some REITs are showing signs of improvement as interest rates decline.

Looking Ahead to the Final Quarter of 2024

In the upcoming earnings calls, monitoring management’s perspectives on declining interest rates for Singapore banks and REITs is crucial. With expectations of exceeding previous year dividends and considerations for dividend reinvestment plans, cautious optimism prevails. The potential for further market rallies and planning for profit-taking strategies towards year-end are on the horizon.

In conclusion, the recent macro boost from the Fed’s rate cut has positively impacted the investor portfolio. Despite some uncertainties and fluctuations, strategic management and monitoring of market conditions remain key for continued success. Stay informed and engaged for further updates and insights on financial independence.