**Excise Duty Adjustments on Beer Across Europe in 2024**

- Estonia has increased its excise duty on beer, raising it from €12.70 to €13.34 per hectoliter per alcohol content as of January 2024. This change translates to an additional €0.01 per drink.

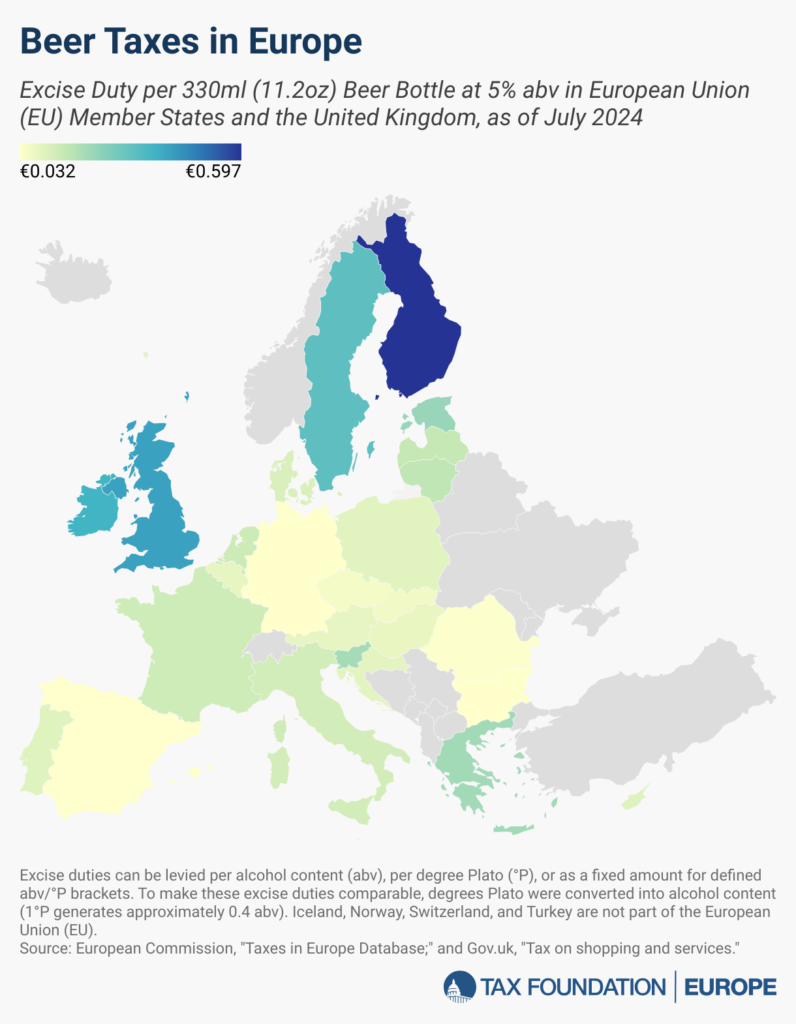

- In contrast, Finland has reduced its excise duty on beer from €38.05 to €36.20 per hectoliter in January 2024, making each drink €0.03 cheaper.

- France’s excise duty on beer climbed from €7.82 to €7.96 per hectoliter per alcohol content in January 2024, resulting in a €0.04 increase per drink.

- Lithuania raised its excise duty on beer from €8.60 to €9.46 per hectoliter per alcohol content in January 2024, equating to an extra €0.014 per drink.

- Latvia implemented an excise duty increase from €8.20 to €9.00 per hectoliter per alcohol content in March 2024, adding approximately €0.013 per drink.

- Several other EU countries witnessed minor adjustments in their beer excise rates, either due to legislated rate changes or fluctuations in currency exchange rates to euros, resulting in tax variations of less than €0.01 per drink.

**Understanding the Purpose of Beer Excise Taxes**

The rationale behind beer excise taxes is clear: governments levy these taxes to discourage alcohol consumption while generating revenue from products that are widely consumed yet socially scrutinized. Despite their intentions, beer taxes often act as a blunt tool in harm reduction.

**Alcohol Tax Policies in Europe: A Comparative View**

Alcohol tax policies in Europe vary significantly beyond just beer. Generally, beer is subject to higher taxes than wine, with some countries choosing not to impose any excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

on wine. However, beer is taxed more lightly compared to spirits.

**Evolving Trends in the Alcohol Industry and Taxation**

Innovation in the alcohol industry has blurred traditional categories. Craft brewing, with its vast array of flavors and alcohol content, has transformed the beer sector, dramatically increasing the variety of available beers. Malt liquor highlights category differentiation with its higher alcohol content. Ready-to-drink cocktails, often considered distilled spirit drinks, present a unique challenge, as their alcohol content, once mixed, is more akin to beer than spirits.

**Conclusion: Monitoring Future Tax Policy Changes**

With the continuously evolving alcohol landscape, staying informed about potential changes in tax policies is essential.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.