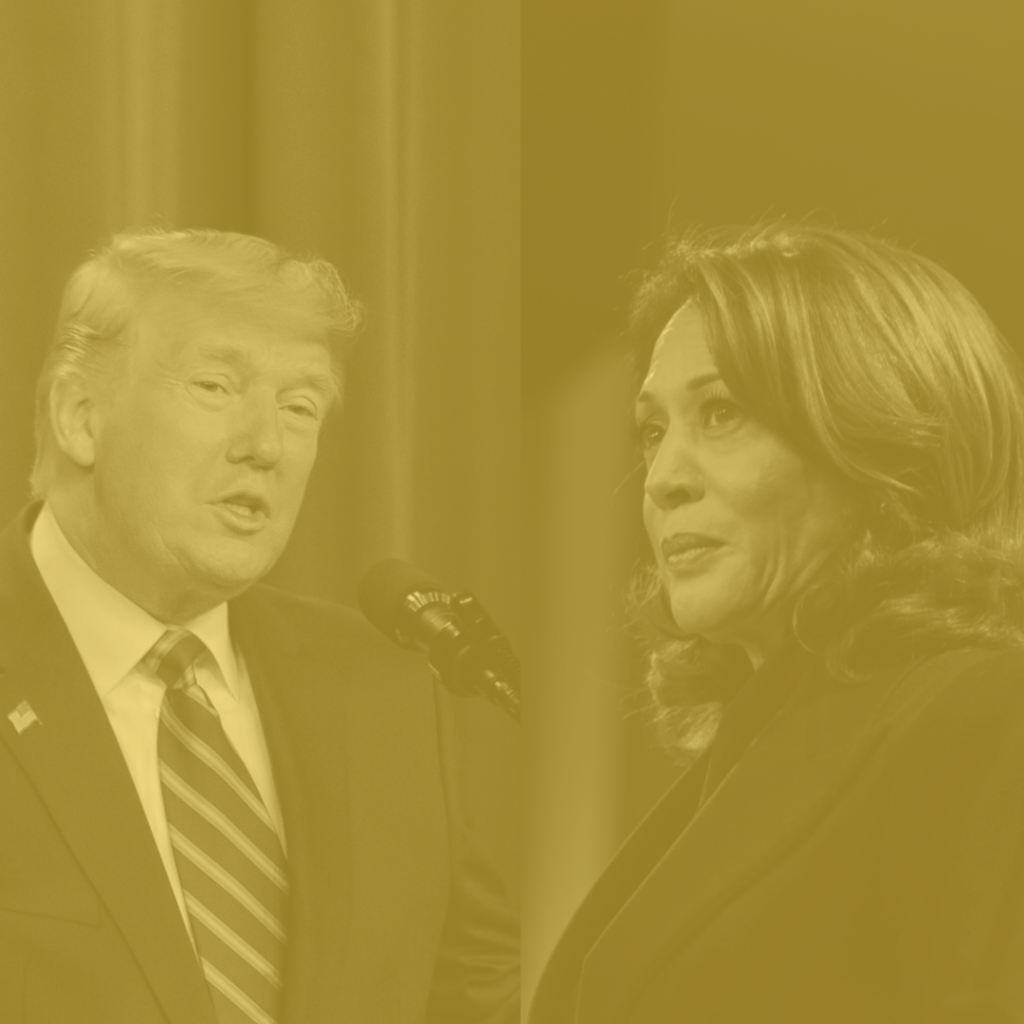

Neither presidential candidate presents an ideal tax plan. What modifications could Trump and Harris implement in their tax strategies to better benefit American citizens and the economy? In this episode, we evaluate their proposals and suggest actionable improvements.

Join Kyle Hulehan and Erica York, Senior Economist and Research Director, as they examine how Trump could enhance take-home pay by increasing the standard deduction and revising tariff policies. Meanwhile, Harris’s approach to stimulating wage growth includes reducing corporate taxes and expanding investment deductions, all while safeguarding labor rights.

Key Tax Plan Improvements for 2024 Election

- Kamala Harris Tax Plan Ideas: Explore potential changes and analyses here.

- Donald Trump Tax Plan Ideas: Discover detailed insights here.

- Tracking 2024 Presidential Tax Plans: Follow updates here.

- Trump’s Proposed Overtime Tax Exemption: Understand its impact on work decisions here.

- Harris’s Corporate Tax Rates: Review state-level implications here.

- Trump’s Tariff Proposals: Analyze potential tariff impacts here.

Note: This episode is part of an ongoing series exploring taxes in the 2024 election. Catch related discussions here, here, and here.

Listen on your favorite platform: Apple Podcasts, Google Podcasts, Spotify, Castbox, Stitcher, Amazon Music, RSS Feed.

Stay Informed on Tax Policies Impacting You

Subscribe for insights from our trusted experts delivered straight to your inbox.

Share