Bitcoin’s Price Surge: Will it Reach New All-Time Highs?

A Positive Market Sentiment

Bitcoin has been steadily climbing towards the $70,000 mark after crossing $60,000, a price it hasn’t seen in months. Investors are eager to see if Bitcoin can break past key resistance levels to set new all-time highs. The current sentiment, as measured by the Fear and Greed Index, is at a “Greed” level of around 70, indicating a positive outlook but not extreme greed levels that could signal a market top.

Last year, when the Fear and Greed Index reached similar levels, Bitcoin saw significant growth, doubling from $34,000 to $73,000 in the following months.

Crucial Support Levels

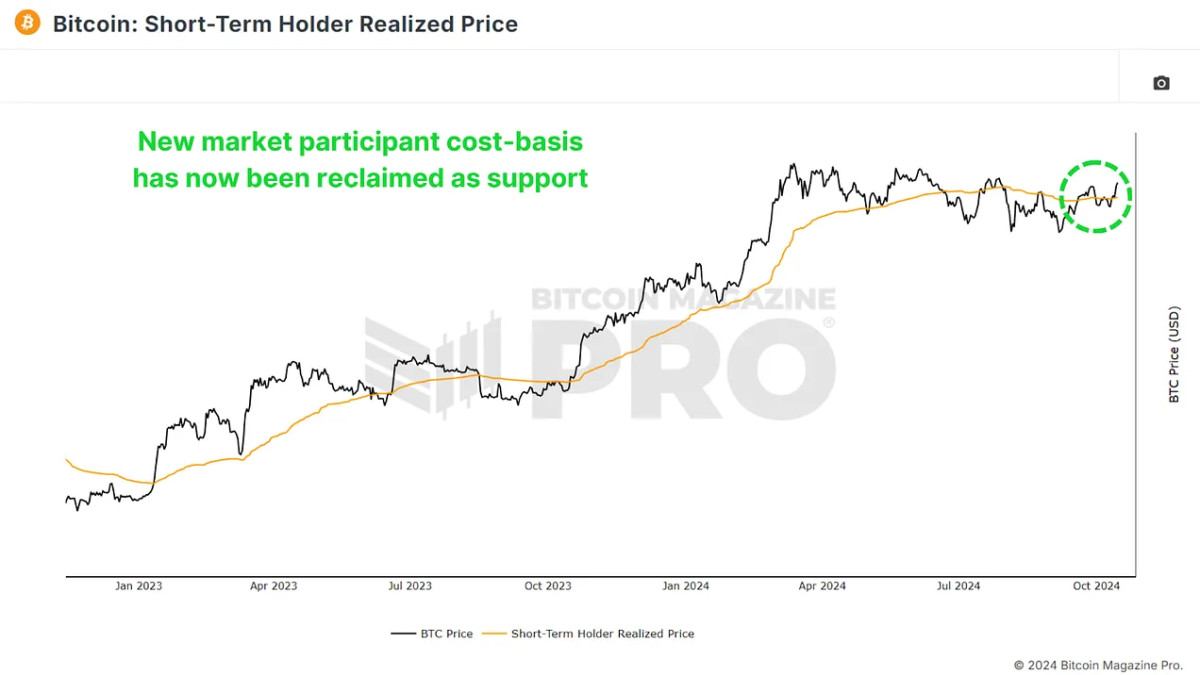

The Short-Term Holder Realized Price currently sits around $62,000, acting as a support level for Bitcoin during bull markets. Staying above this price is key for Bitcoin’s rally as breaking below it historically leads to market weakness.

Monitoring funding rates is crucial to gauge market stability, with rates currently sitting at neutral levels, indicating a balanced market sentiment and reduced risk of liquidation cascades.

Challenges Ahead

Bitcoin faces resistance at key levels, including $70,000 and its all-time high of $73,000-$74,000. Breaking these levels will be a significant bullish signal but might require multiple attempts. Despite challenges, reclaiming the 200 daily moving average is a positive technical indicator.

Institutional Confidence

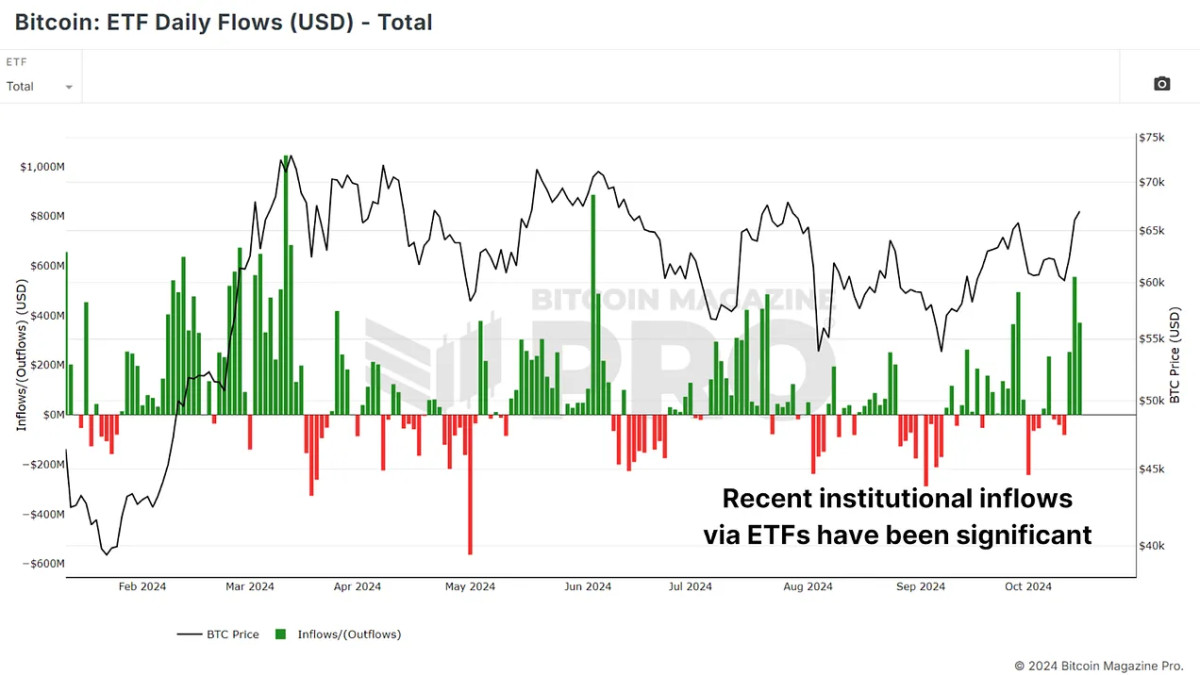

Institutional money flowing into Bitcoin ETFs signals growing confidence in the asset and provides a stable support base. With the improving macro environment, Bitcoin could see a boost as investors potentially shift from traditional assets to the risk-on realm of Bitcoin.

Conclusion

Bitcoin’s positive sentiment, technical indicators, and institutional inflows paint a bullish picture, but challenges remain with key resistance levels. Monitoring market dynamics carefully will be crucial as Bitcoin navigates its path to new heights.

For more insights, watch a recent YouTube video here.