Despite being pitched as a tax on large out-of-state businesses, Oregon’s Measure 118 functions as an exceptionally high-rate sales tax on everyday goods and services, as we’ve previously explained. Perhaps even more surprisingly, this tax targeting large multinational enterprises will significantly impact Oregon’s main street businesses.

At first glance, it seems intuitive that small-to-midsized Oregon businesses, falling below the threshold required to remit the tax, should be unaffected. However, just like consumers ultimately bear the burden of sales tax even though they don’t remit it to the Department of Revenue, Oregon businesses will indirectly pay under the tax created by Measure 118, disadvantaging them against larger out-of-state rivals.

How Measure 118 Works

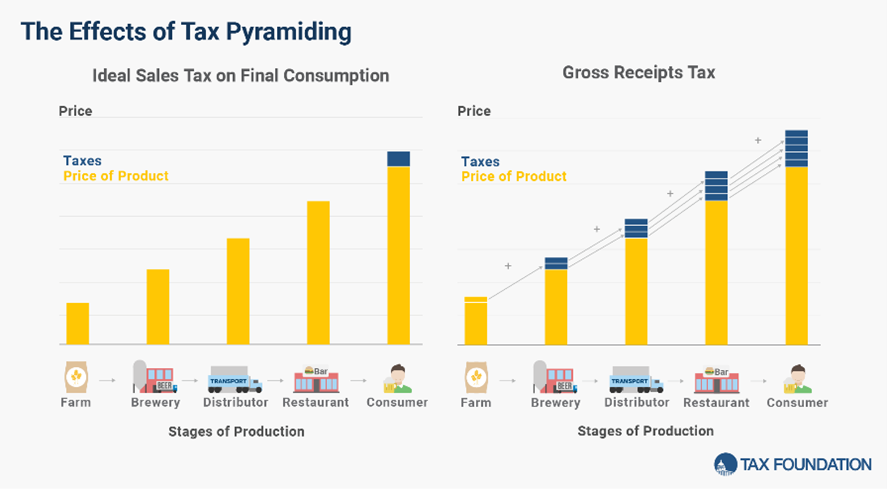

Measure 118 imposes a 3 percent gross receipts tax on large businesses with more than $25 million in revenue. These businesses pay the higher of either their liability under the existing corporate income tax or this tax on gross revenue. In practice, the gross receipts tax will almost always be the higher tax and is levied at every production stage, increasing the tax burden significantly.

Impact on Oregon’s Small Businesses

No large business selling into Oregon can avoid the tax at the retail level. While smaller businesses are exempt, they’re far from advantaged.

The real challenge lies in the various layers of taxation throughout the supply chain. When an Oregon business buys raw materials or machinery from a large business, the tax is applied. The same goes for energy, office equipment, advertising, vehicle leases, and subscription services. Each taxed transaction stacks upon the previous, leading to a phenomenon known as tax pyramiding.

In contrast, larger businesses can circumvent many tax layers through vertical integration, bringing various functions in-house and avoiding taxable transactions or by shifting operations out of Oregon altogether. Small businesses, however, typically cannot relocate and thus bear multiple layers of this tax, making their production significantly more expensive.

Consumer Prices and Competitive Disadvantage

While large businesses will also be impacted by this gross receipts tax, smaller, local businesses are particularly vulnerable. This tax, indifferent to profit margins or ability to pay, becomes especially burdensome when imposed multiple times across a single production chain.

The result is higher consumer prices, as businesses pass the tax cost down the chain, embedding it into the final product price. Small Oregon-based businesses, subjected to multiple layers of tax, will find it challenging to compete with out-of-state rivals that don’t face the same tax burdens. This could force them to raise prices significantly or risk losing market share, potentially leading them out of business.

Conclusion

Measure 118 was designed to target large businesses, but the real victims will be Oregon’s small businesses. They will face multiple layers of tax on everything they produce, leaving them at a competitive disadvantage. Proponents claim Oregonians can avoid higher prices by buying local, but the reality is quite the opposite. Small local businesses, with most production stages in Oregon, will be hardest hit, ultimately raising prices for consumers and stifling local economic growth.

Note: This is part of a series exploring Oregon Measure 118. See our related analysis:

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share