Key Findings

- The increasing levels of waste and pollution, coupled with the burden on taxpayers to address environmental problems, have prompted policymakers in the US and globally to make producers responsible, either financially or operationally, for the lifecycle of their products.

- Extended Producer Responsibility (EPR) is a policy approach designed to shift the costs of waste management from taxpayers to producers, encouraging the use of recycled materials.

- Imposing low-rate taxes on unrecycled raw materials, such as virgin plastics, alongside policies that foster innovation in recycling, would promote a circular economy—where materials are reused and recycled to minimize waste.

- Policies that narrowly focus on recycled content mandates, product-specific burdens, or other restrictive regulations may lead to counterproductive environmental outcomes.

- Uniformity in policies across states would decrease compliance costs and optimize environmental results.

- Well-designed policies can facilitate a circular economy, achieve environmental goals, and stimulate economic growth through efficient recycling and waste disposal industries.

Introduction

The ever-growing amounts of consumer waste and pollution have long been environmental issues. Concurrently, taxpayer burdens of waste management have increased with rising waste generation, making it imperative to craft public policies that enhance recycling and align taxation with better environmental outcomes.

Though no official national data is available, estimates suggest that the US recycling rate is around 33%, significantly lower than the EPA’s goal of a 50% recycling rate by 2030.[1] Some plastic materials are not viable for recycling with current technologies. Only 21% of recyclable materials are effectively processed under existing systems.[2]

Governments are seeking to enact policies that effectively reduce waste, promote the recycling and reuse of materials, and transfer waste management costs back to producers, while avoiding undue economic burdens.

Extended producer responsibility (EPR) includes policies aimed at making producers manage their products’ end-of-life cycle.[3]

The direction of US and global environmental policies suggests that implementing EPR is inevitable. Various states have already launched their own EPR programs, leading to a patchwork of policies that pose unique challenges and costs for multi-state businesses. Policymakers must consider design harmonization between jurisdictions.

While some EPR policy designs may achieve their objectives, others risk significant unintended consequences, undercutting both economic and environmental goals. Though EPR may not be a panacea, it will likely play a role in future policy frameworks.

A Blueprint for Effective Policy

An EPR policy rooted in principles of simplicity, transparency, neutrality, and stability is most likely to reduce waste, promote recycling, fairly distribute burdens, and establish a sustainable circular economy. Following these principles minimizes economic costs and may even foster long-term gains from resource conservation.

Key principles for an effective EPR policy include:

- Implementing a low-rate tax on unrecycled raw materials early in the production process.

- Using tax revenues to bolster weaker links in the circular economy.

- Applying international border adjustments on imports from countries lacking EPR policies.

- Avoiding restrictive mandates and regulations.

EPR initiatives are most effective when taxes on unrecycled materials create a financial incentive for producers to opt for recycled inputs.

Neutral taxes across production processes avoid market distortions. Unneutral treatment, such as industry-specific rebates, can undermine environmental objectives and resource conservation.

Taxes should reflect the actual burdens materials impose on the waste management system. Simple taxes applied early minimize administrative complexities and double taxation risks.

For example, taxing virgin plastic at the manufacturer level is more efficient than taxing downstream wholesalers or retailers, who may not know the material content.

Revenues should be dedicated to enhancing recycling infrastructure and waste management systems to ensure sustainability.

Transparency in EPR taxes helps in explaining the benefits and trade-offs to the public, fostering genuine support.

EPR taxes, effectively a proxy user fee, help cover waste management costs proportionately, ensuring sustainable resource use.

EPR policies should avoid mandates on recycled content or changes in production processes, which act as indirect production caps and undermine competition. Instead, taxing new materials encourages reuse without counterproductive mandates.

Uniform EPR policies across states would reduce compliance burdens for multi-state businesses and could be more effectively instituted at the federal level.

Enabling competition and innovation in the recycling industry is necessary alongside new tax policies to ensure a robust and efficient circular economy.

Even though US policy may not significantly impact global waste producers, levying taxes on imports ensures a level playing field for domestic manufacturers.

A well-designed EPR policy can shift waste management costs effectively without hampering production or increasing consumer prices excessively.

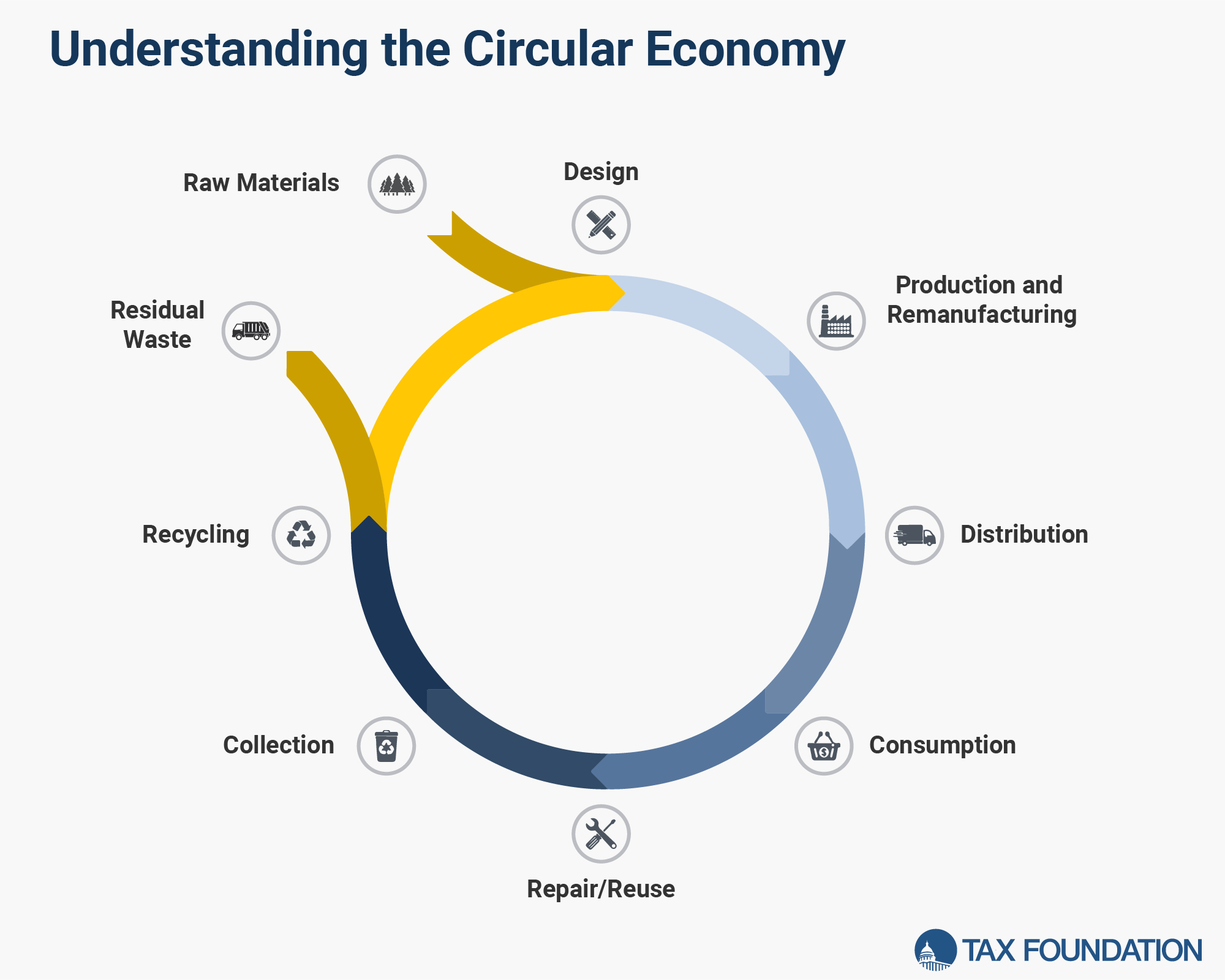

A Circular Economy

A circular economy aims to minimize waste by keeping materials circulating back into production through recycling.

Designing products for end-of-life recyclability reduces costs and incentivizes producers.

Producers adopting more sustainable practices ensure better outcomes for waste management and recycling.

Consumers can be educated and incentivized to recycle more effectively.

Haulers, recycling facilities, and waste management providers optimize processes to maximize recycling efficiency.

Currently, the US lacks the infrastructure to sustain a circular economy.[10] Advancing technology and infrastructure is necessary to make recycling economically viable.

EPR policies should not rely solely on current inefficient systems; instead, they should encourage innovation and competition.

An Unbroken Chain

Successful circular economy initiatives require functioning systems at each step. Any failure in the process can jeopardize the entire system.

Policymakers must consider all potential consequences of EPR policies to ensure economic and environmental benefits.

Important EPR Design Considerations

Policies to Avoid

Certain policy measures, like recycled content mandates, indirect production caps, or product bans, have harmful consequences and should be avoided.

Overly prescriptive policies may stifle competition and innovation.

Covered Products

An extensive list of covered materials ensures neutrality and avoids market distortions. Special considerations must be made for certain materials like paint, batteries, and electronics.

Semantics

Clear and flexible regulatory definitions are essential to accommodate technological advancements and innovation.

Advanced recycling should be recognized as a valid process to enhance recycling rates.[20]

Eco-Modulation of Fees

Eco-modulated fees based on environmental impact can incentivize better production practices but must be carefully structured to avoid unintended consequences.

Producer Responsibility Organizations

PROs can help administer EPR policies but must be designed to minimize bureaucratic complexity and maximize efficiency.

Efficient PROs should only include actual producers and importers, directing funds to critical infrastructure improvements.

Trade-Offs and Drawbacks of EPR Programs

EPR policies impose higher production costs and may initially raise consumer prices. Accurate environmental impact assessments are challenging. Domestic policies may not influence waste and pollution in other countries.

Higher costs of inefficient recycling processes must not outweigh the benefits of resource conservation.

Current State Programs

Several states, including Washington[28], Maine[29], Oregon[30], Colorado[31], and California[33], have implemented EPR programs with varying degrees of success.

Consistency across state lines is critical for reducing compliance costs and improving environmental outcomes.

Conclusion

Increasing waste levels and the associated taxpayer burden have pushed policymakers to adopt EPR policies, making producers responsible for their products’ lifecycle.

Implementing low-rate, neutral taxes on unrecycled raw materials and using the revenues for infrastructure improvements can encourage recycling and economic growth.

A well-structured EPR program adheres to principles of simplicity, neutrality, and transparency, fostering a circular economy, achieving environmental goals, and promoting economic growth.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

[1] Arlene Karidis, “Recycling Outlook 2023: Improving Plastic Recycling Rates,” Waste360, Jan. 18, 2023, https://www.waste360.com/waste-recycling/recycling-outlook-2023-improving-plastic-recycling-rates; Environmental Protection Agency, “U.S. National Recycling Goal,” Feb. 22, 2024, https://www.epa.gov/circulareconomy/us-national-recycling-goal.

[2] The Recycling Partnership, State of Recycling: The Present and Future of Residential Recycling in the U.S., The Recycling Partnership, Jan. 31, 2024, https://www.recyclingpartnership.org/wp-content/uploads/2024/01/SORR-ByTheNumbers-1.31.24.pdf.

[3] National Conference of State Legislatures, “Extended Producer Responsibility,” Oct. 24, 2023, https://www.ncsl.org/environment-and-natural-resources/extended-producer-responsibility.

[4] America’s Plastic Makers, “Extended Producer Responsibility,” American Chemistry Council, April 2024, https://www.plasticmakers.org/extended-producer-responsibility/; American Chemistry Council, “Plastic Makers Support Fair, Feasible Policy Approaches to Improve Packaging Recycling,” Feb. 3, 2021, https://www.americanchemistry.com/chemistry-in-america/news-trends/press-release/2021/plastic-makers-support-fair-feasible-policy-approaches-to-improve-packaging-recycling; Global Partners for Plastics Circularity, “Global Agreement,” https://www.plasticscircularity.org/global-agreement/.

[5] Institute for Energy Research, “California Is Throwing Away More Plastic After It Banned Plastic Bags,” Mar. 1, 2024, https://www.instituteforenergyresearch.org/climate-change/california-is-throwing-away-more-plastic-after-it-banned-plastic-bags/; Rachel Meidl, “Smart Policy and Innovative Technologies, Like Advanced Recycling, Will Deliver on Climate and Sustainability Goals,” Baker Institute, Apr. 19, 2021, https://www.bakerinstitute.org/research/smart-policy-and-innovative-technologies-advanced-recycling-will-deliver-climate-and-sustainability.

[6] Hannah Ritchie, “Where does the plastic in our oceans come from?,” Our World in Data, May 1, 2024, https://www.ourworldindata.org/ocean-plastics; Louis Lugas Wicaksono, “Which Countries Pollute the Most Ocean Plastic Waste?,” Visual Capitalist, Feb. 17, 2023, https://www.visualcapitalist.com/cp/visualized-ocean-plastic-waste-pollution-by-country/; Hannah Ritchie, Veronika Samborska, and Max Roser, “Plastic Pollution,” Our World in Data, 2023, https://www.ourworldindata.org/plastic-pollution; Jenna Jambeck et al., “Plastic waste inputs from land into the ocean,” Science 347:6223 (February 2015): 768-771, https://www.science.org/doi/10.1126/science.1260352.

[7] Sean Bray, “What the EU’s Carbon Border Adjustment Mechanism Means for Europe and the United States,” Tax Foundation, Apr. 26, 2023, https://www.taxfoundation.org/blog/cbam-eu-carbon-border-tax/.

[8] Adam Hoffer, “Taxes and Illicit Trade,” Tax Foundation, Aug. 10, 2023, https://taxfoundation.org/blog/illicit-trade-taxes-counterfeit-cigarettes/.

[9] Environmental Protection Agency, “What is a Circular Economy?,” EPA, Aug. 26, 2024, https://www.epa.gov/circulareconomy/what-circular-economy.

[10] Prashanth Sabbineni, “INSIGHT: How the US can achieve high plastic recycling rates,” Independent Commodity Intelligence Services, Jul., 6, 2021, https://www.icis.com/explore/resources/news/2021/07/06/10660235/insight-how-the-us-can-achieve-high-plastic-recycling-rates/; Craig Cookson, “30 by ’30?,” American Chemistry Council, Aug. 22, 2021, https://www.americanchemistry.com/chemistry-in-america/news-trends/blog-post/2021/30-by-30.