**State GILTI Tax Base Adjustments: Recent Developments and Ongoing Concerns**

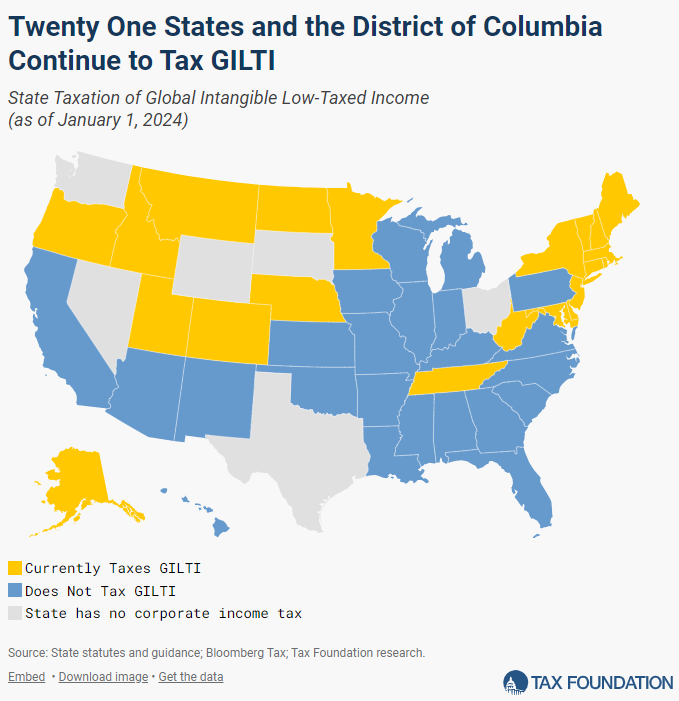

The landscape of states’ treatment of Global Intangible Low-Taxed Income (GILTI) has seen modest changes in recent years. Since our last update on May 20, 2021, New Jersey and Minnesota are the only states to revise their state tax frameworks to address GILTI tax base adjustments:

- New Jersey significantly lowered its GILTI tax base from 50% to 5%, by categorizing GILTI as a deemed dividend. Under New Jersey’s Dividend Received Deduction, corporations can deduct up to 100% of dividends and deemed dividends from state corporate taxes, though a 5% inclusion is mandatory for GILTI.

- Minnesota enacted F. 1938 in 2023, eliminating the previous 100% GILTI income subtraction that exempted Minnesota corporations from GILTI in state corporate income tax calculations. Starting in tax year 2023, Minnesota imposes a tax on 50% of GILTI.

**Key Concerns: GILTI’s Inclusion in State Tax Codes**

The adoption of GILTI in state corporate tax codes has sparked notable debate. Originally introduced to target profit shifting by multinational corporations (MNCs) with foreign operations, GILTI aims to ensure a minimum tax level on international profits. Its state-level inclusion raises several issues, including potential violations of the Dormant Commerce Clause, increased complexity in tax filings for MNCs, and the artificial inflation of tax liabilities due to varying apportionment rules.

The Dormant Commerce Clause limits states from enacting legislation that discriminates against or burdens interstate commerce. Although these GILTI policies have yet to face successful legal challenges, arguments suggest they may contradict constitutional guidelines for various reasons.

First, taxing GILTI at the state level can impose a higher tax rate on foreign income than domestic income, complicating cross-border and interstate business operations. MNCs must navigate a convoluted array of state-specific tax regulations affecting global income. States like Minnesota, having enacted laws such as SF 1938, now impose a tax on 50% of foreign GILTI, potentially disadvantaging businesses headquartered within those states. This taxation may lead to double taxation at the state level since GILTI’s state treatment lacks federal adjustments such as foreign tax credits or deductions, resulting in an unfair burden on MNCs.

Moreover, GILTI’s state-level inclusion complicates tax compliance, as each state’s unique corporate tax regime introduces additional filing requirements. Differences in state approaches to GILTI increase compliance burdens and demand significant resources to ensure adherence.

The absence of uniformity across state tax codes mandates that MNCs manage complex filing requirements, navigate various apportionment formulas, and determine GILTI inclusion or exclusion from taxable income. This discord forces businesses to allocate substantial resources for compliance, often demanding advanced tax planning to avoid overpayment or penalties. Small to mid-sized MNCs, lacking the resources of larger counterparts, face increased risks related to compliance and potential financial strain.

The result is an artificial inflation of corporate tax liabilities for MNCs, as states tax GILTI without aligning with economic realities. Apportionment formulas based on property, payroll, and sales fail to account for the international nature of GILTI, thereby inaccurately attributing foreign income as domestic and overextending state taxing authority.

Given these complexities, states imposing GILTI taxes heighten filing challenges and increase compliance costs, creating economic uncertainty and legal risks. Despite these issues, 21 states and the District of Columbia continue to pursue this taxation approach.

Stay Updated on State Tax Policies Impacting You

Subscribe to receive expert insights delivered directly to your inbox.