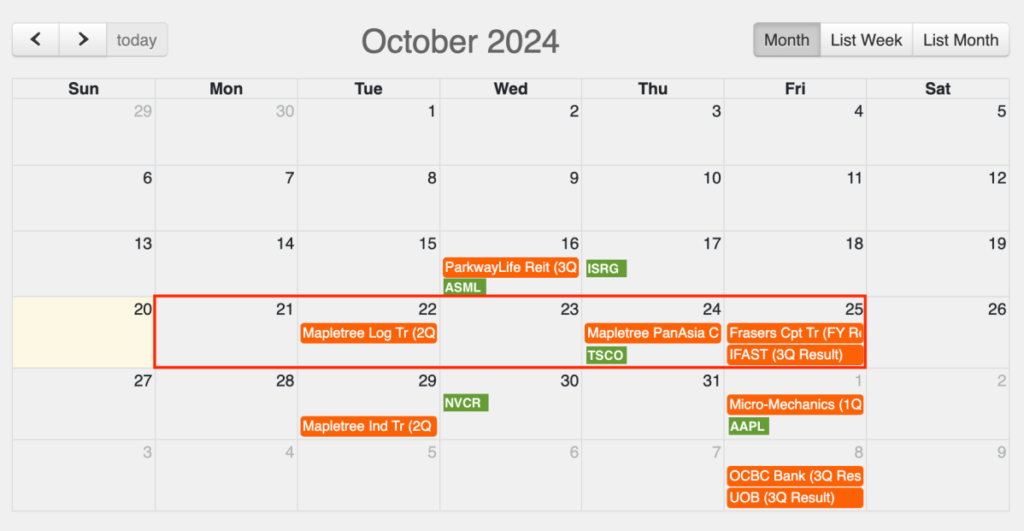

Last week, ParkwayLife REIT (SGX: C2PU), or PLife, and Intuitive Surgical, Inc (NASDAQ: ISRG) reported their quarterly earnings.

For the upcoming week, I am eagerly anticipating the financial reports from the following companies: Frasers Centrepoint Trust (SGX: J69U), Mapletree Logistics Trust (SGX: M44U), Mapletree Pan Asia Commercial Trust (SGX: N2IU), iFAST Corporation Limited (SGX: AIY), and Tractor Supply Company (NASDAQ: TSCO).

Among these entities, my positive outlook is on FCT. Key performance indicators like occupancy rates and rental reversion are expected to stay robust. With only 67% of its debt hedged to fixed rate interest, I anticipate a decrease in the average cost of debt. I foresee a consistent S$0.06 dividend per unit (DPU) for the latter half of the year.

MLT and MPACT are likely to encounter challenges in occupancy for Chinese properties and fluctuations in currency exchange rates in the last quarter. Additionally, the average borrowing cost may see a slight uptick. Therefore, I predict a similar DPU to the 1Q 2024/25 at approximately S$0.021, representing a 7 to 9% decrease compared to the previous year.

iFAST is anticipated to deliver strong results with a significant surge in net profit expected year-on-year (YOY). I will closely monitor the performance of iFAST Global Bank (iGB). Hopefully, the company can uphold the growth momentum of customer deposits and reduce the quarterly loss to below S$1 million.

Conversely, I foresee another subdued quarter from Tractor Supply. The company faces challenges with a projected -0.5% to 1% same store sales growth for FY 2024. The guided earnings per share of US$10.00 to US$10.40 is in line with the previous year’s US$10.15.

Despite prevailing difficulties in the retail landscape, maintaining sales and net income showcases the resilience and strength of the company.

Discover more from Towards Financial Independence

Subscribe to get the latest posts sent to your email.