With the U.S. presidential election on the horizon, it’s essential to explore how previous elections have affected Bitcoin’s price. Historically, the U.S. stock market has displayed significant trends during election cycles. Considering Bitcoin’s correlation with equities, especially the S&P 500, these trends could provide valuable insights into future developments.

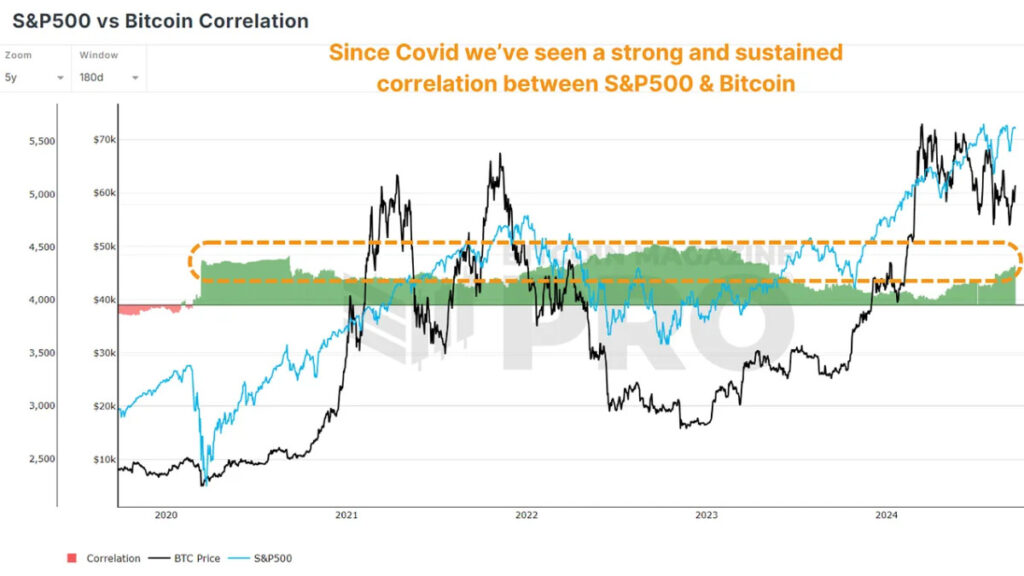

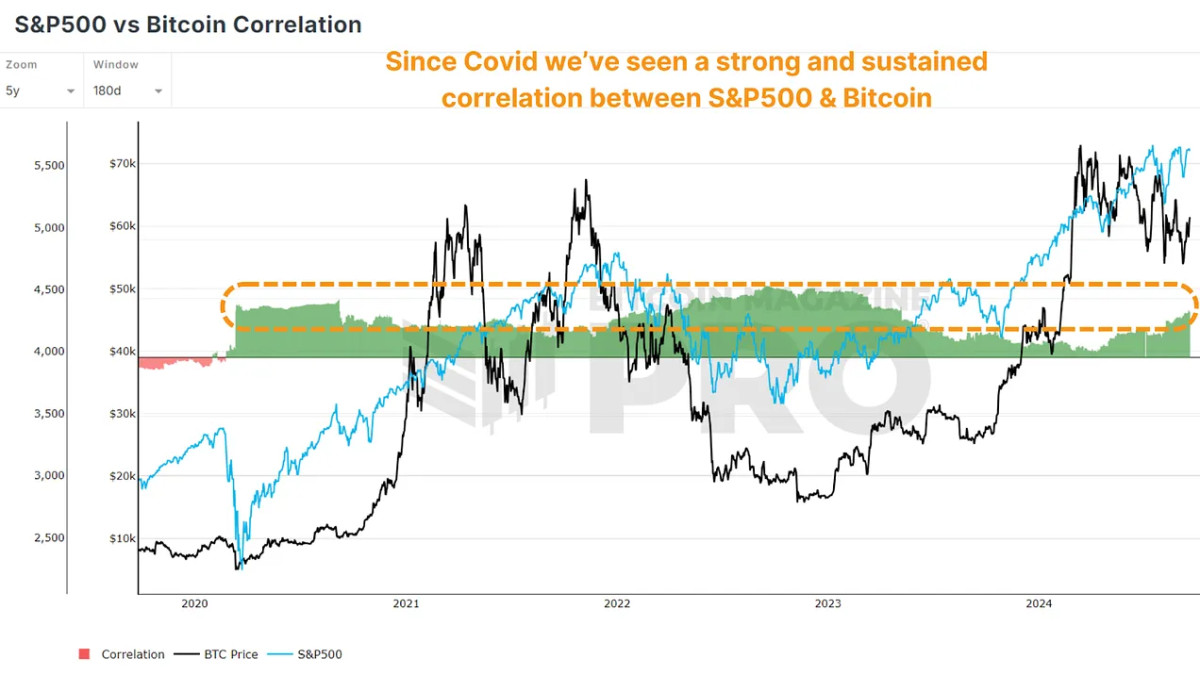

The Relationship Between Bitcoin and the S&P 500

Bitcoin’s correlation with the S&P 500 has been strong, particularly during BTC’s bullish cycles and periods of positive sentiment in traditional markets. While there is speculation that this correlation may weaken as Bitcoin matures and establishes itself as more than a speculative asset, there is no concrete evidence to support this yet.

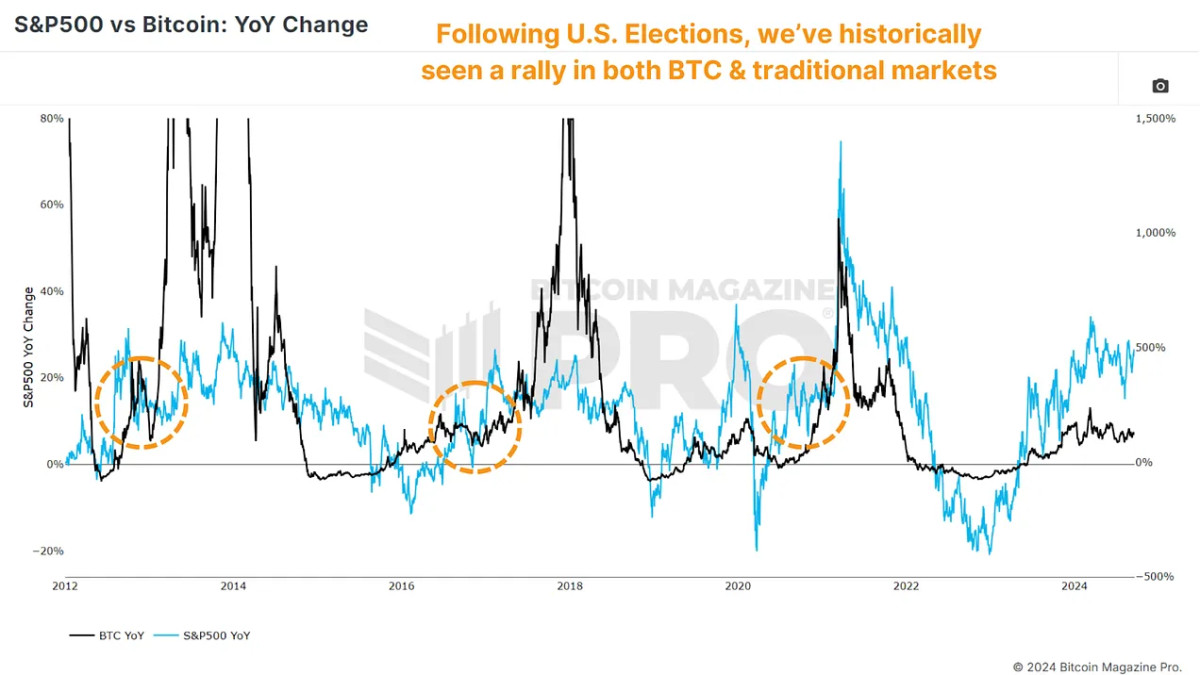

Post-Election Market Performance

The S&P 500 tends to experience positive momentum following U.S. presidential elections. This trend has persisted over several decades, with the stock market often seeing substantial gains in the year following an election. The S&P500 vs Bitcoin YoY Change chart illustrates the price movements of BTC and the S&P 500 after election events.

In the 2012 election, the S&P 500 recorded an 11% year-on-year growth, which surged to approximately 32% the following year. Similar patterns were observed in the 2016 and 2020 elections, with significant post-election market rallies.

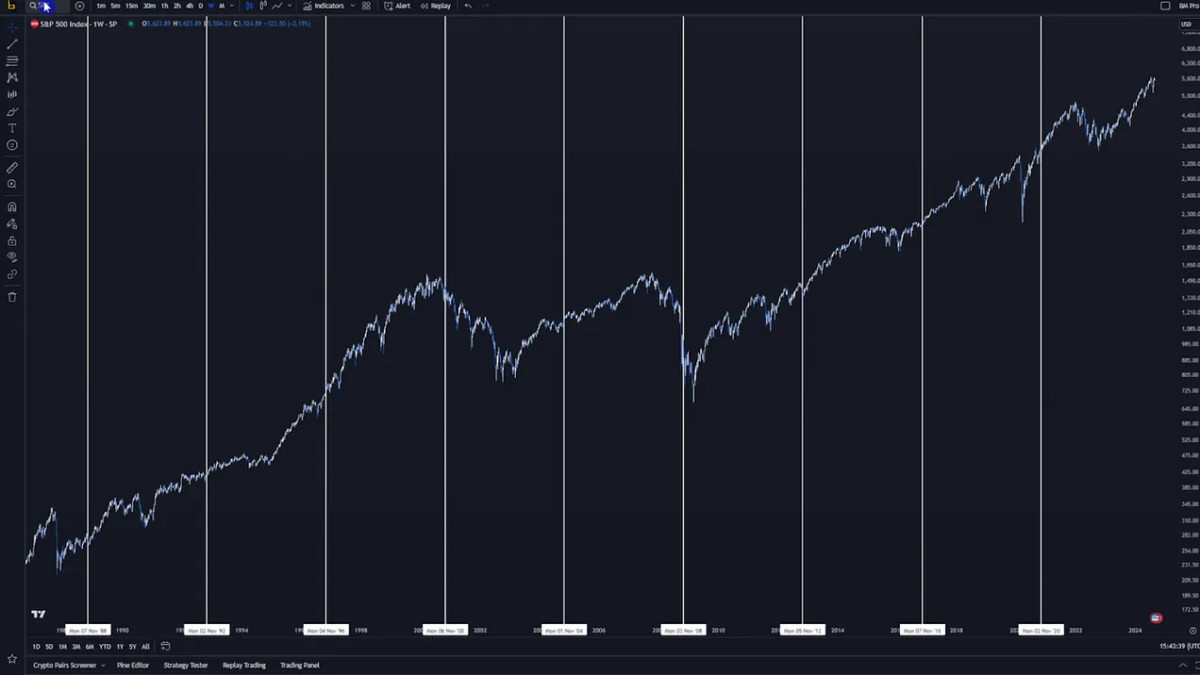

Long-Term Market Trends

Analysis of S&P 500 returns from the past four decades, encompassing ten election cycles, indicates a positive trajectory in the stock market post-election. Only one instance, in 2000 during the dot-com bubble burst, resulted in negative returns twelve months after the election.

Regardless of the winning party (Republican or Democrat), positive market trends post-election are more about resolving uncertainty and boosting investor confidence than political affiliation.

Potential Impact on Bitcoin

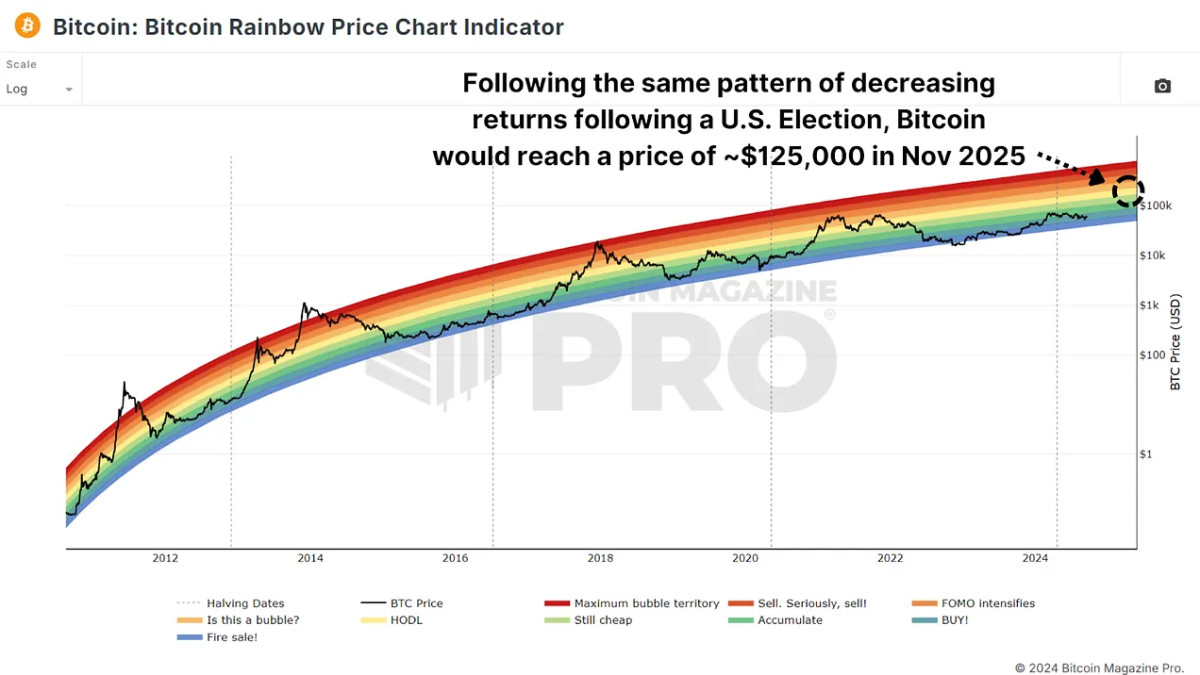

Looking ahead to the 2024 U.S. presidential election, historical data suggests that Bitcoin could see significant price increases following the event. Past trends indicate that Bitcoin’s price could reach $1,000,000 based on 2012 gains, $500,000 based on 2016 gains, or $250,000 based on 2020 gains.

Considering a pattern of diminishing returns after each election cycle, it is plausible that Bitcoin may reach $125,000 by November 2025. This aligns with historical data and corresponds to the middle bands of the Rainbow Price Chart. Moreover, previous cycles have shown that Bitcoin tends to surpass initial peak gains.

Key Takeaways

The data indicates a positive market outlook for both the stock market and Bitcoin following a U.S. presidential election. With the next election drawing closer, investors in Bitcoin may find reasons for optimism in the upcoming months.

For a deeper dive into this subject, watch the YouTube video: Will The U.S. Election Be Bullish For Bitcoin?

.