Title: Warren Buffet’s Tiered Portfolio Allocation Strategy Unveiled: A Guide to Organizing Your Investments

Recently, Happily at InvestingNote shed light on Warren Buffet’s unique portfolio allocation strategy, revealing a tiered approach rather than equal weighting. This detailed breakdown includes Mapletree Industrial Trust (SGX: ME8U) as a significant holding at 30%.

Have you ever considered implementing a tiered system for your own portfolio? While unequal weighting is common, organizing investments into distinct tiers can offer clarity and confidence in each holding.

Back in 2021, a tier system was introduced to categorize US micro-caps, providing a useful way to manage and gauge confidence in each holding. However, as the micro-cap adventure concluded in April 2022, the system fell out of regular reference.

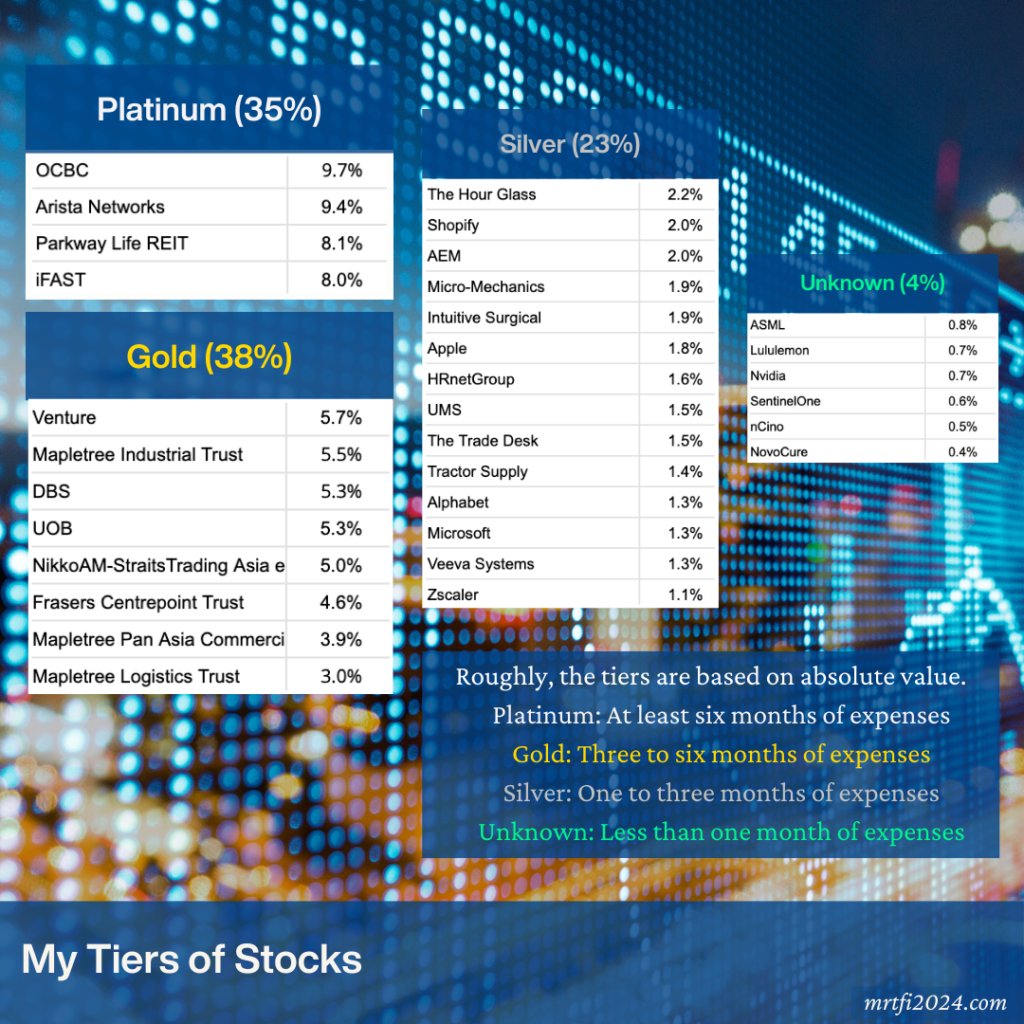

The tiers, ranging from Platinum to Unknown, are based on absolute value to send a clear message about risk and balance in the portfolio. This unique approach prompts a deeper evaluation of individual holdings and overall investment strategy.

Examining the current portfolio, key questions emerge:

– Comfort level with stocks in each tier

– Evolution of the portfolio over time

– Value of continuing with the tiered categorization

With careful consideration, the tier system has proven effective in managing the portfolio. Maintaining positions below 10% of the total portfolio and following a balanced approach of income and growth investments have led to stable returns and dividends.

Notably, Singapore Banks and REITs dominate the Platinum and Gold tiers, contributing significantly to dividend yields. Unique income counters like Venture Corporation Limited (SGX: V03) add diversity and confidence in higher positions.

The Silver tier houses US growth counters like Arista Networks, Inc (NASDAQ: ANET) and iFAST Corporation Limited (SGX: AIY), showcasing potential for further growth and returns.

In contrast, the Unknown tier includes newer holdings like NVIDIA CORP (NASDAQ: NVDA) and Lululemon Athletica (NASDAQ: LULU), highlighting a balance between risk and belief in future potential.

Reflecting on the evolution of the portfolio, maintaining small initial positions for growth counters proved beneficial in managing risks and capitalizing on upside potential. An increase in income counters through profits from growth investments enhanced dividend yields over time.

While not essential, the tier system serves as a valuable tool for visual representation and periodic reassessment of holdings. Considerations for consolidation and realignment within the tiers can optimize portfolio performance and position for future growth.

In conclusion, let your portfolio evolve organically, focusing on nurturing successful investments and eliminating underperforming ones. By following a structured tiered approach like Warren Buffet, you can achieve a well-diversified and balanced investment portfolio. Continue to monitor and adjust your holdings to align with your financial goals and risk tolerance for long-term success.