In a recent analysis shared on X, Kelly Greer, Vice President of Trading at Galaxy Digital, lays out a compelling case for Bitcoin potentially reaching $118,000 by the end of the year. Drawing from historical data, current market conditions, and broader economic factors, Greer argues that various elements are aligning to create a favorable environment for Bitcoin.

Why Bitcoin Could Reach $118,000

Greer points to Bitcoin’s historically strong performance in previous fourth quarters, where the cryptocurrency saw an average return of around 85% from its intra-quarter high. This asymmetry suggests significant upside potential compared to downside risks, with past scenarios showing returns as high as 230%.

Positive Market Indicators

Greer emphasizes that a modest 85% increase in Bitcoin’s price could result in a year-end value of $118,000. Factors such as the upcoming US election and the attraction towards other assets like gold and China’s A-shares have led to an underallocation in the market, leaving room for Bitcoin to potentially shine.

She also highlights key reasons for a bullish outlook on Bitcoin, citing low volatility, global stimulus measures, and positive ETF flows. Additionally, the recent trend of Bitcoin miners partnering with hyperscalers and the overall decrease in supply overhangs contribute to a favorable environment for Bitcoin.

Potential Risks and Opportunities

While acknowledging potential risks from Federal Reserve actions and equity market pullbacks, Greer maintains an overall positive sentiment towards Bitcoin. She describes Bitcoin as a reflexive asset that can attract more flows as its price increases, creating a self-reinforcing cycle.

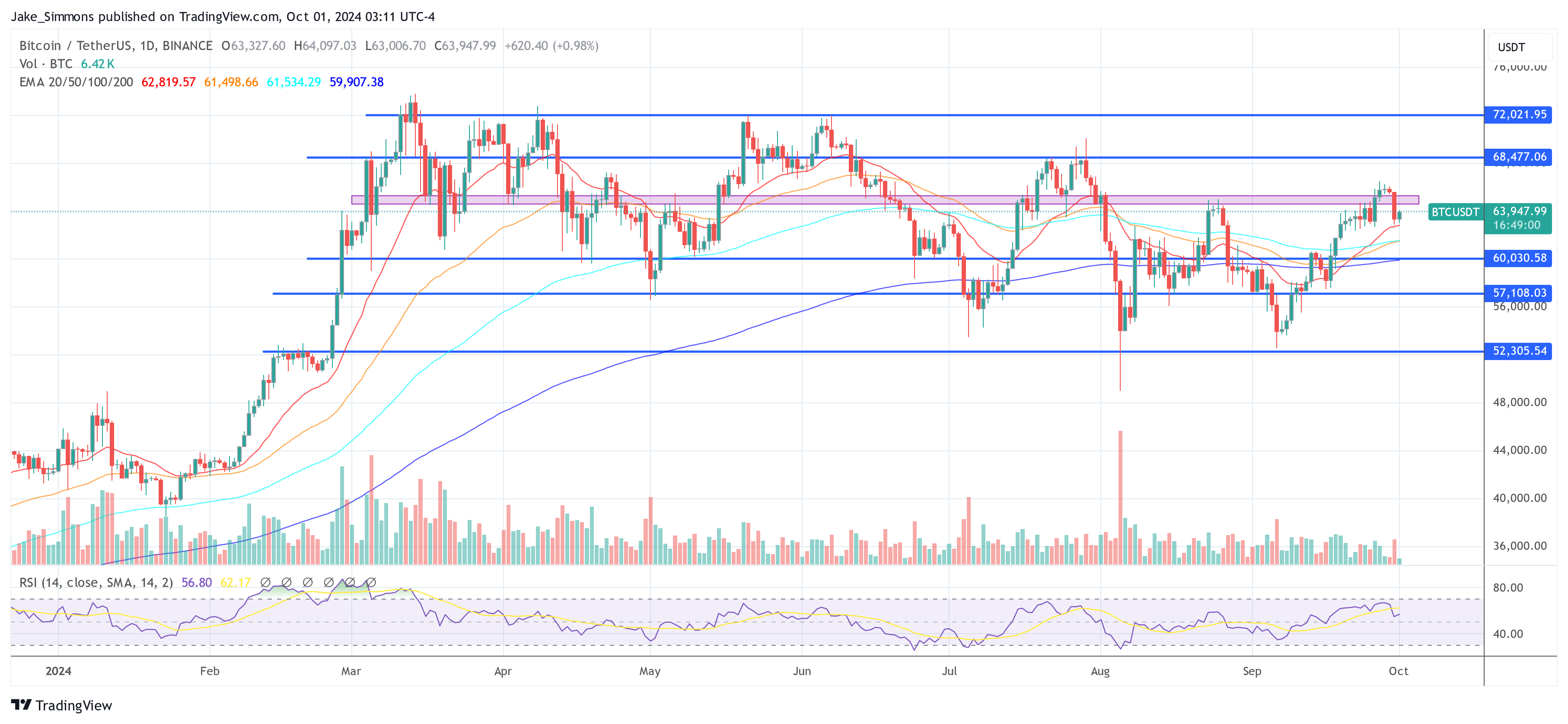

As Bitcoin currently trades at $63,947, Greer sees the breaking of key price levels as indicators for potential acceleration in inflows and continued growth in Q4, reflecting the positive momentum in the market.

In conclusion, Greer’s analysis presents a strong case for Bitcoin’s potential to soar to $118,000 by year-end, backed by solid market indicators and favorable economic conditions. Investors are encouraged to stay tuned for further developments in the cryptocurrency space as Bitcoin continues to capture attention and investment interest.

Featured image created with DALL.E, chart from TradingView.com