Bitcoin Price Surges to $66,000 as Correlation with Stock Market Strengthens

Bitcoin continues its positive trajectory, reaching $66,000 on Friday, September 27th, amid a surge in global liquidity. Recent data suggests a growing correlation between the cryptocurrency and the US stock market. How will this impact investor behavior?

Bitcoin And S&P 500 Performance in September

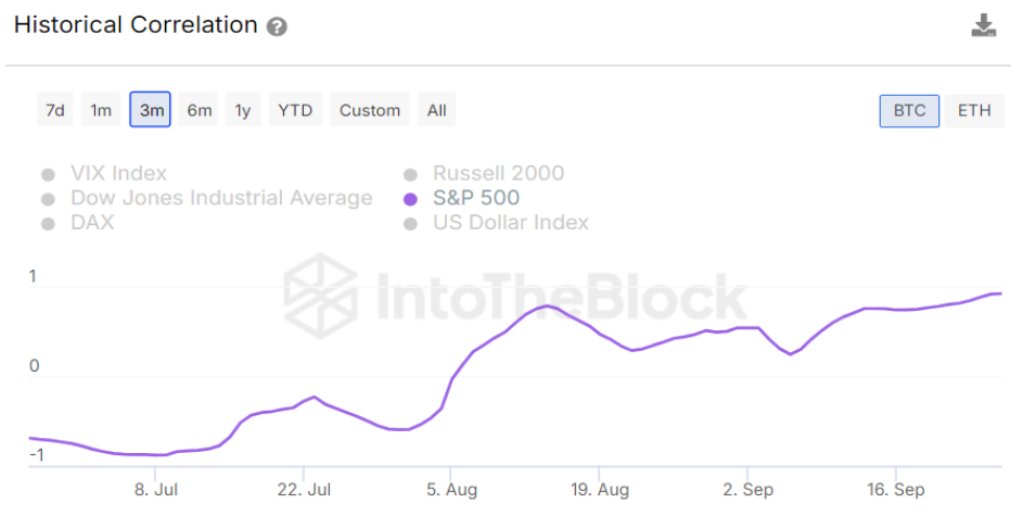

Recent findings from crypto intelligence firm IntoTheBlock reveal the highest correlation between Bitcoin and the S&P 500 in over two years. While Bitcoin saw an 11% increase in September, the S&P 500 index also experienced a 4% rise.

Source: IntoTheBlock/X

The relationship between the stock market and cryptocurrency market intrigues investors seeking opportunities. Despite the correlation, it may limit diversification options for investors.

As of now, Bitcoin is priced at $66,024 with a 1.1% increase in the past 24 hours, while the S&P 500 Index stands around 5.8K with a 0.4% rise.

Global Liquidity Surges by $1.426 Trillion

A notable increase in global liquidity, rising by $1.426 trillion in the past week, has benefitted Bitcoin and other risk assets. This liquidity boost is expected to continue into October.

Global liquidity surged by $1.426 trillion this week, reaching $131.6 trillion. #Bitcoin and other risk assets are gaining, with potential for further growth in October.

— Ali (@ali_charts) September 27, 2024

Bitcoin’s value has been on the rise due to the surge in global liquidity, suggesting positive outlook for October.

BTC breaks above $66,000 on the daily timeframe | Source: BTCUSDT chart from TradingView

Featured image from iStock, chart from TradingView