Steno Research Predicts Ethereum’s Revival in Response to Interest Rate Cut by the Fed

While Bitcoin and other altcoins surge, Ethereum remains stagnant, but a turnaround may be on the horizon. Despite a dip against Bitcoin post-merge in 2022, a recent report suggests brighter days ahead for the second-largest digital asset.

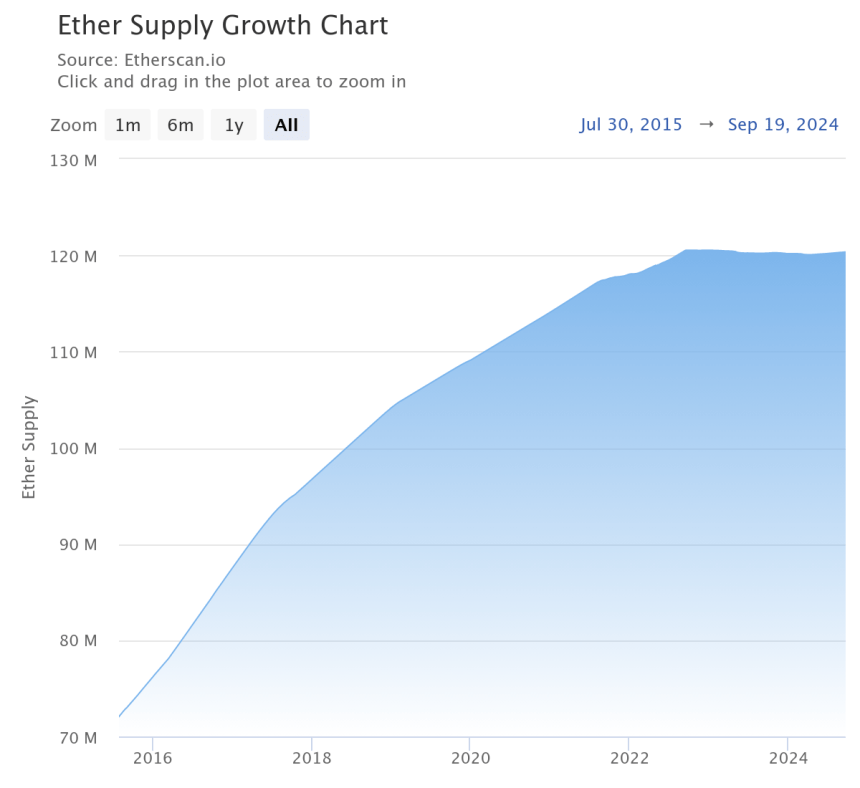

The Ethereum merge marked a shift from PoW to PoS, trimming new ETH issuance by 3%. Consequently, ETH supply growth has turned negative as more ETH gets burned than minted, evident in the plateaued supply growth since September 2022.

The recent downtrend of ETH against BTC, dropping to 0.04, signals a loss of previous gains. Nevertheless, Steno Research points to a potential resurgence for Ethereum in the near future.

The Fed’s interest rate decrease could drive ETH’s price growth ahead. During the last alt season, Ethereum’s value doubled compared to BTC in a short span, spurred by increased on-chain activity from DeFi, NFTs, and stablecoin issuance.

Senior Cryptocurrency Analyst at Steno Research, Mads Eberhardt, outlined the chain reaction: lowered rates lead to more activity, boosting ETH transactional revenue, curbing supply expansion, ultimately pushing ETH price higher.

Eberhardt further highlights the outperformance potential of Ethereum ETFs over Bitcoin’s amidst factors like U.S. spot ETFs, MicroStrategy’s influence, and a recent dip in Ethereum’s transactional revenue.

Despite challenges, Ethereum’s reputation remains solid, evidenced by Bitwise’s CIO likening it to the ‘Microsoft of blockchains’, hinting at a comeback post-US elections. ETH is currently valued at $2,543, marking a 4.3% gain in 24 hours.

Featured image from Unsplash, Charts from Etherscan.io and Tradingview.com