Title: Expert Analyst Analyzes Key Bitcoin Indicator Signaling Potential Last Major Dip

In his latest video analysis titled “BITCOIN’S One Indicator Signaling LAST Major Dip,” Dan Gambardello, a noted crypto analyst with a significant YouTube following, delves into Bitcoin’s latest price action. After dropping to $60,000, concerns about a deeper price crash have gripped the market.

Why This Could Be The Final Leg Down For Bitcoin

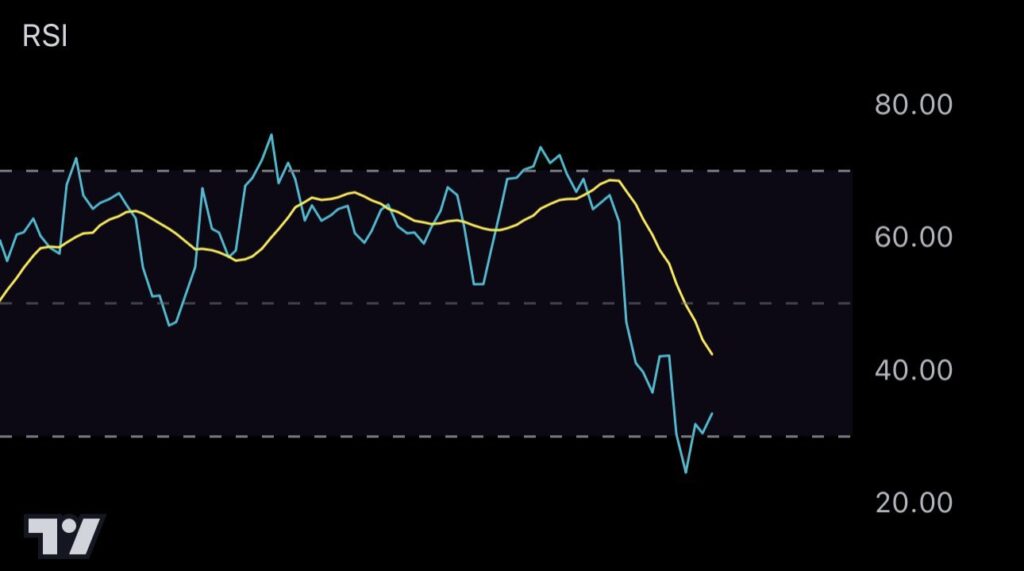

Gambardello highlights the significance of the daily and six-hour charts, particularly focusing on the Relative Strength Index (RSI) hitting oversold levels. This indicator traditionally signals a potential bullish reversal, hinting at the end of the current price dip.

Reinforcing the cyclical nature of Bitcoin’s market dynamics, Gambardello analyzes historical data to suggest a pattern of initial declines followed by strong recoveries by the end of October. He also discusses the potential scenarios around Bitcoin’s lower trend line, speculating on a robust support level.

Further deepening his analysis, Gambardello refers to the performance of Bitcoin in past halving years, indicating the possibility of a similar trajectory this year. He believes that the current market conditions could lead to a sustained upward trend.

Key Takeaways

Overall, Gambardello’s analysis points toward a potential end to the current price dip, with indicators signaling a bullish reversal. The market could see a strong bounce after a possible short-term capitulation. While uncertainties remain, historical patterns and technical indicators suggest a promising outlook for Bitcoin’s future.

Concluding Thoughts

As Bitcoin continues to trade around $60,899, investors are closely watching for signs of a market turnaround. Gambardello’s insights provide valuable perspectives on the potential trajectory of Bitcoin’s price movements. Stay informed, monitor key indicators, and stay tuned for more updates on Bitcoin’s market performance.