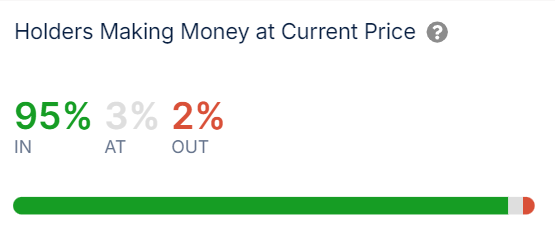

According to on-chain data, approximately 95% of all Bitcoin holders are currently enjoying gains following the recent surge in the asset’s price.

Minimal Bitcoin Addresses Remain at Loss

In a recent update on X, market intelligence platform IntoTheBlock has provided insights into the profitability of Bitcoin holders using on-chain data analysis.

IntoTheBlock analyzed the transaction history of each address on the network to determine the average acquisition price of coins. Addresses with a cost basis below the current price are considered profitable, while those with a higher cost basis are deemed at a loss.

The distribution of address types on the Bitcoin network at present is as follows:

Notably, approximately 95% of Bitcoin holders are currently in profit, with only about 2% underwater. The remaining 3% are at a break-even point.

This skewed distribution toward profit holders is attributed to the recent price rally of the asset. IntoTheBlock notes that high profitability levels can indicate strong bullish momentum but also the potential for overextension.

Furthermore, a significant number of addresses are currently in profit, hinting at the possibility of a profit-taking event. It remains to be seen how demand will react to absorb potential selling pressure.

On a positive note, Bitcoin inflows to “accumulation addresses” have surged recently, potentially signaling another phase of accumulation.

Bitcoin Price Update

As of writing, Bitcoin is trading around $67,400, marking an increase of over 11% in the past week.

In conclusion, the majority of Bitcoin holders are currently in profit, with a potential for a profit-taking event due to high profitability levels. The influx of funds into accumulation addresses suggests a possible accumulation phase. Keep an eye on Bitcoin’s price movements for further insights into market sentiment.