Bitcoin Sees Revival in Retail On-Chain Activity

Rising Retail Participation Boosts Bitcoin’s Outlook

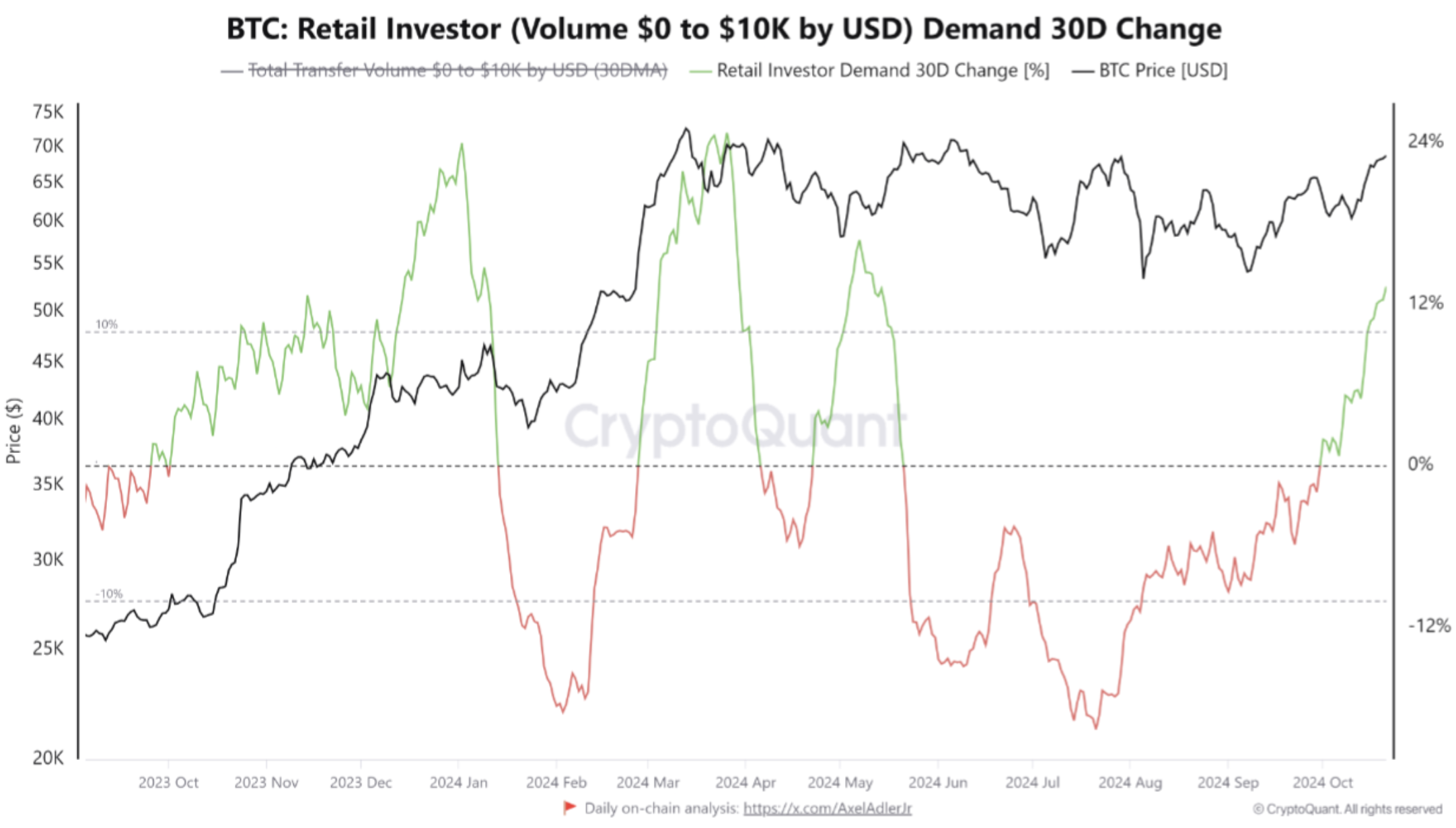

Recent analysis by CryptoQuant reveals a surge in BTC transactions under $10,000, indicating a shift in market sentiment towards higher risk tolerance.

Insights on Bitcoin Retail Demand

Retail interest in Bitcoin struggled post ATH but has recently surged by 13% in the last month, coinciding with a 7% price increase from $63,142 to $67,346. This uptick in retail demand signals a potential Q4 2024 rally for BTC.

A noticeable rebound in BTC and other cryptos post geopolitical tensions hints towards a return to risk-on behavior in the digital asset market.

While retail on-chain activity dipped, institutional investors remained active, setting the stage for a lower risk-averse pattern.

Anticipating a Q4 2024 Rally

Rising retail engagement indicates growing interest in BTC. However, potential volatility tied to the US presidential elections looms over BTC prices.

Expert Views on Bitcoin’s Future

Market experts link a Q4 2024 crypto rally to the US election outcome, with predictions suggesting a possible jump to $80,000 if there’s no Democratic sweep.

Bitcoin dominance hitting a new cycle high of 58.9% may pose a challenge for altcoins, potentially leading to muted returns for alternative cryptocurrencies.

Geography-specific retail trends, like lower BTC prices in South Korea, showcase varying investor sentiments towards digital assets, highlighting potential market differences.

Featured image from Unsplash, charts from CryptoQuant and Tradingview.com