Title: Investing in Semiconductor Recovery: UMS Integration and AEM Holdings Show Promise

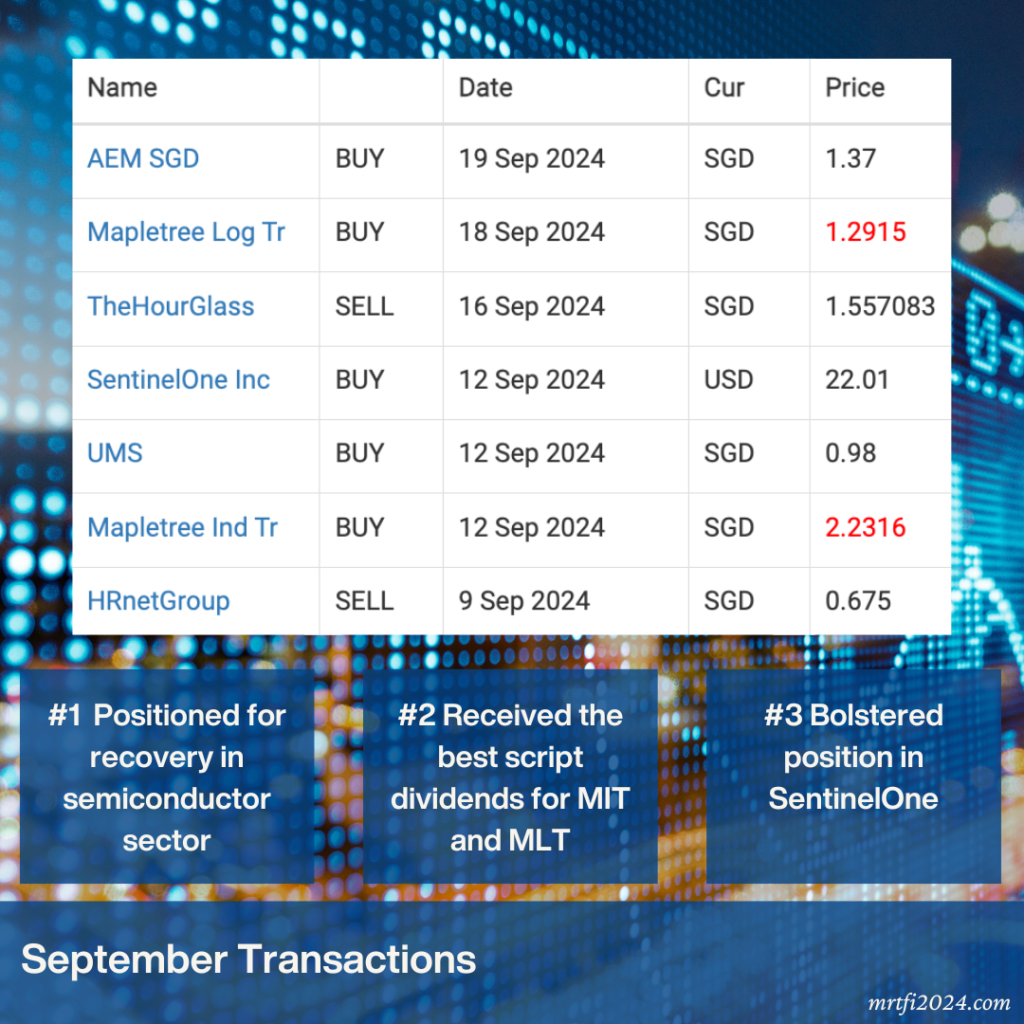

I recently explored opportunities in the semiconductor sector and found encouraging signs of a turnaround, prompting me to increase my holdings in UMS Integration (Ltd) and AEM Holdings. However, due to investment limits, I had to divest in HRnetGroup Ltd and The Hour Glass Limited.

While I believe in the resilience of the divested companies, I see greater potential returns in the semiconductor sector once it recovers, which I anticipate by the latter half of 2025. The key is to position our portfolio for recovery rather than timing the market.

In terms of REITs, both Mapletree Industrial Trust and Mapletree Logistics Trust have shown promising returns through script dividends, but future dividends may become more expensive.

On the U.S. front, I have bolstered my position in SentinelOne, Inc. due to positive developments such as securing FedRAMP authorization and forming a partnership with Lenovo.

To delve deeper into these investments and strategies, check out related articles for more insights. Subscribe to Towards Financial Independence for the latest updates and analysis. Join me on this journey towards financial growth and independence.