Investing Opportunities in Singapore Semiconductor Companies: A Renewed Focus on UMS Holdings

After analyzing the recent performance of AEM Holdings (SGX: AWX) and Micro-Mechanics Holdings Ltd (SGX: 5DD), both of which have faced challenges in the semiconductor sector, I found signs of recovery for these companies.

While I considered increasing my holdings in AEM and Micro-Mechanics, I decided to explore other opportunities due to reaching my CPF Investment Scheme-Ordinary Account (CPFIS-OA) stocks limit and a preference to avoid investing in the same company using different funding sources.

UMS Holdings: A Renewed Interest

Revisiting UMS Holdings (SGX: 55D), I was impressed by the significant developments since my previous investment. Notable highlights include:

- Applied Materials (NASDAQ: AMAT) now only sources 50% of its needs from UMS.

- Acquisition of a new customer – a Nasdaq-listed semiconductor equipment manufacturer.

- Commencement of production at a new facility in Penang dedicated to the new customer.

- Successful placement of 40 million shares at $1.29.

- Acquisition of additional land for expansion.

- Proposal for a secondary listing on Bursa Malaysia Securities Berhad.

- Proposal for a name change to UMS Integration Limited.

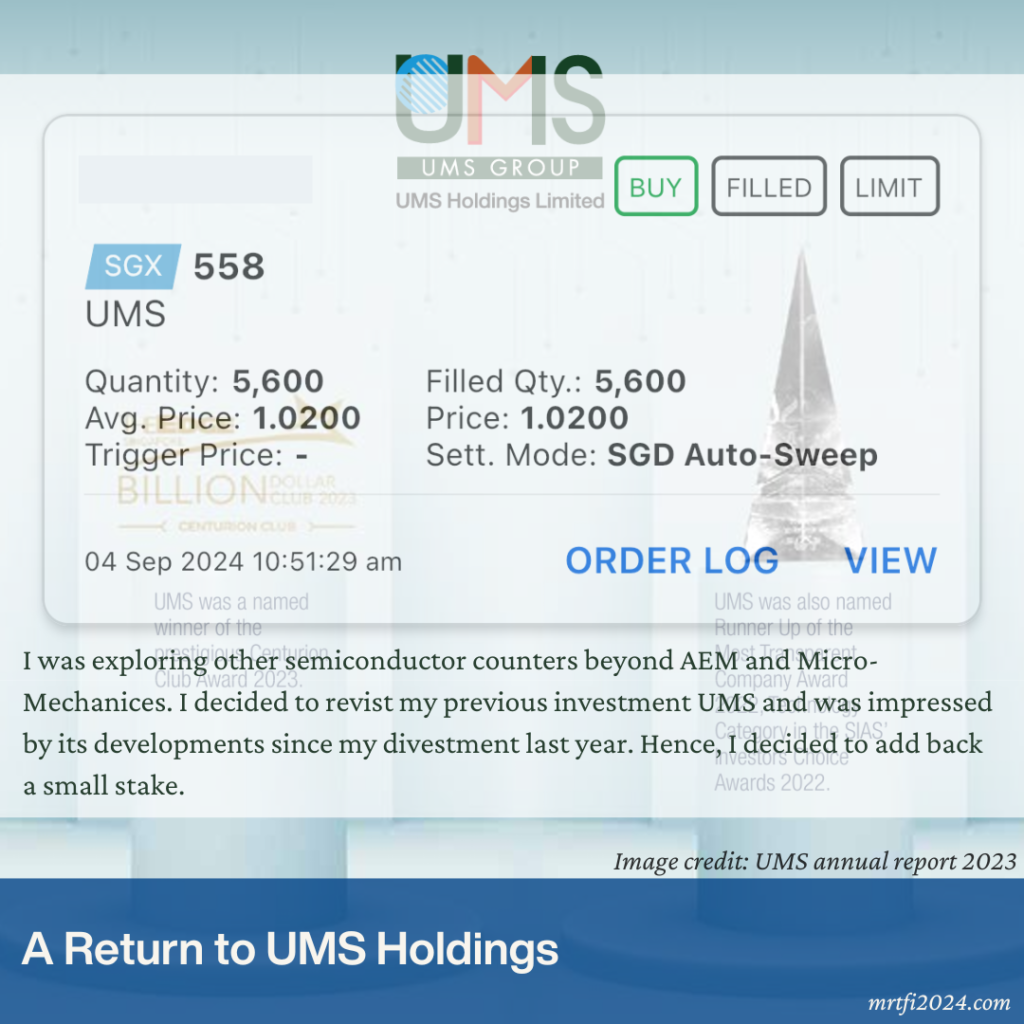

Despite losing orders from Applied Materials to Frencken, I believe UMS is in a stronger position post-transition. Hence, I reinvested in UMS at $1.02, just slightly below my divested price.

Considering Frencken, which now serves Applied Materials and ASML Holding (NASDAQ: ASML), I opted to invest in UMS due to its focus on semiconductor industry and attractive dividend yield.

Conclusion

By analyzing the performance and developments of AEM Holdings, Micro-Mechanics, UMS Holdings, and Frencken, I have made informed investment decisions based on the companies’ positioning within the semiconductor industry and potential for growth.

It is crucial to continuously monitor and assess investments to maximize returns and mitigate risks. While investing in semiconductor companies presents opportunities, diversification and strategic decision-making are key to long-term success in the financial market.

Stay updated on the latest investment insights by subscribing to Towards Financial Independence and be part of the journey towards financial security and growth.