## Rapid Growth of Legal Sports Betting in the United States

Legal sports betting has seen rapid growth since the Supreme Court’s 2018 decision in Murphy vs. NCAA, which allowed states to establish online sports betting markets. Before this ruling, legal sports betting was limited to a handful of states. Today, 38 states and the District of Columbia permit some form of sports betting.

### Varying Sports Betting Markets

Sports betting markets differ significantly across states. States apply various tax rates, sometimes distinguishing between online and in-person wagers. This diversity impacts consumer access to legal sports betting, which can be quite restricted.

Access to legal betting markets is mostly limited by high barriers to entry for operators and geographic restrictions on where players can place bets. Common obstacles include hefty licensing fees and requirements for online sportsbooks to partner with in-state brick-and-mortar operators.

For instance, in Massachusetts, sportsbooks face an initial fee of $5 million, with a $5 million renewal fee every five years. In Pennsylvania, the initial fee is $10 million with a $250,000 renewal fee every five years.

### Partnerships and Regulatory Frameworks

New Jersey mandates online sportsbooks partner with a licensed brick-and-mortar racetrack or casino, while Ohio allows partnerships with professional sports organizations. Other states, like Connecticut, require partnerships with state-approved master gaming operators, while Montana controls the market through its Lottery Commission.

### Geographic and Tax Restrictions

Several states limit where online betting can occur. In Delaware, Mississippi, Montana, New Mexico, North Dakota, South Dakota, Washington, and Wisconsin, betting is only allowed at specific locations like retail casinos or tribal lands.

In other states, online wagers are subject to higher taxes compared to in-person bets. This is evident in Kentucky, Louisiana, Massachusetts, New Jersey, and New York.

### Distribution of Online Sports Betting and Tax Implications

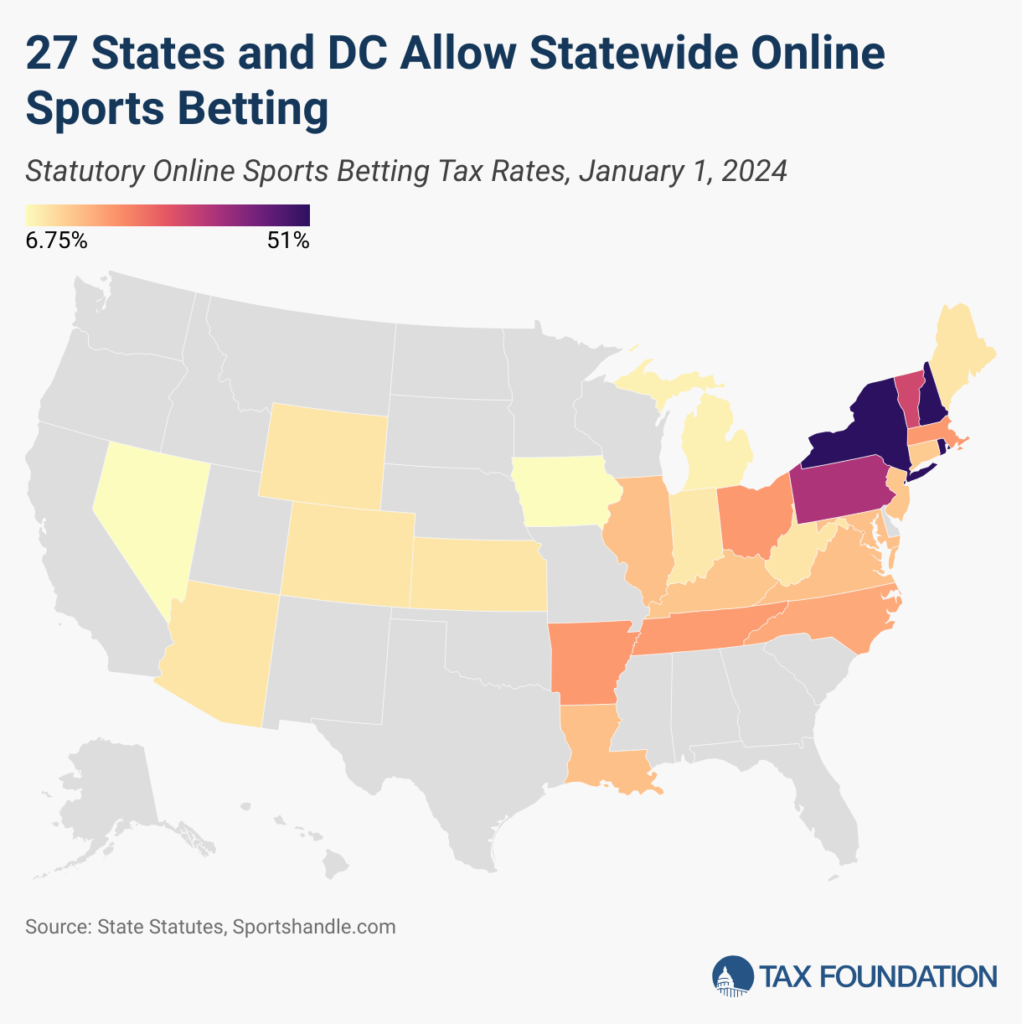

Currently, bettors have statewide online sports betting access in 27 states and the District of Columbia. New Hampshire, New York, and Rhode Island implement the highest tax rate for sportsbooks at 51%, while Nevada and Iowa have the lowest at 6.75%.

### Future Growth and Market Expansion

The sports betting market is expected to grow substantially, especially if more states like Texas and California legalize it. With nationwide legalization, market volume could easily double.

As the tax base expands, tax policy design becomes more crucial. Rates should be low enough to attract participants from black markets to legal, regulated markets.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share