2024 Notable Changes in Marijuana Tax Policies

- Minnesota legalized recreational marijuana and imposed a 10 percent tax on retail gross receipts.

- Ohio legalized recreational marijuana and set a 10 percent tax on retail sales.

- Delaware established a 15 percent tax on retail sales, but business licensure is pending, with retail sales anticipated to begin in March 2025.

- California transitioned from a wholesale-level tax to one based on retail gross receipts.

- New York replaced its THC-content-based tax with a 9 percent ad valorem wholesale tax.

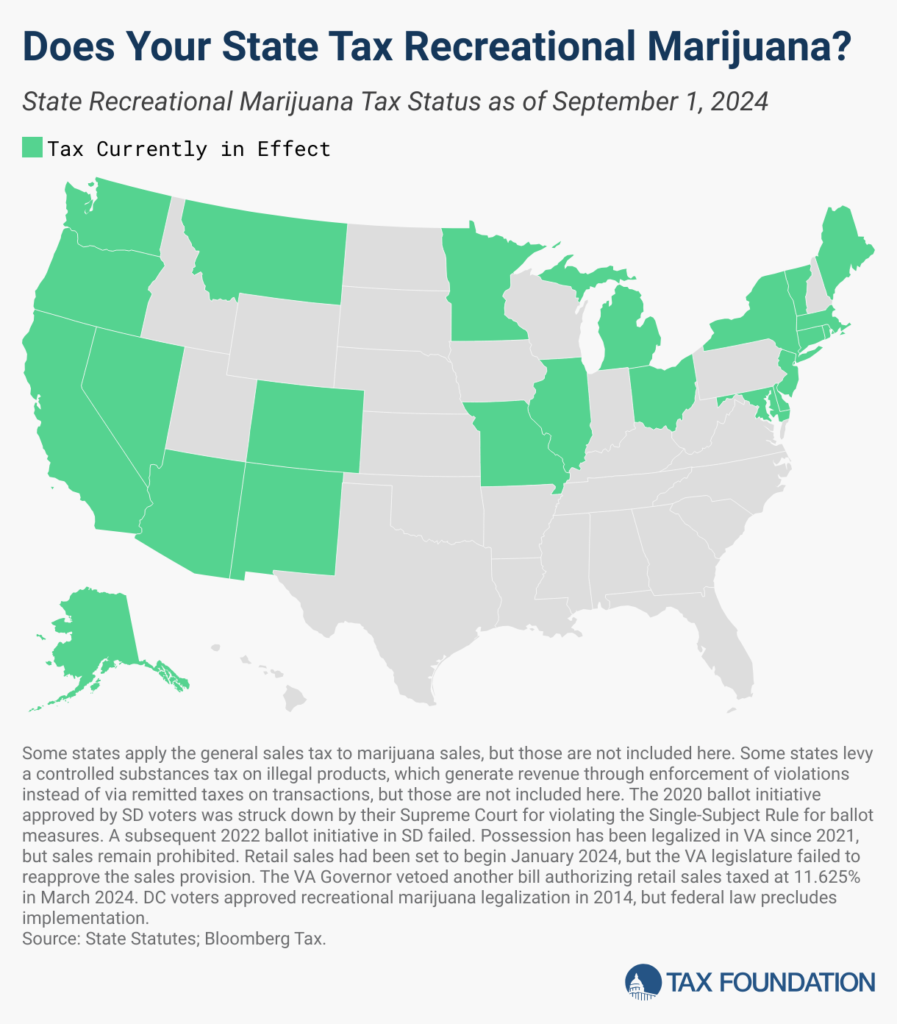

- Virginia did not obtain legislative approval for planned marijuana legalization, and a proposed 11.625 percent tax on recreational sales was vetoed by the governor.

**Widespread Marijuana Legalization and Public Support**

Nearly half of U.S. states have legalized recreational marijuana, with many more permitting medical use. Some states have decriminalized possession while restricting cultivation and sales. A recent Gallup poll reveals that 70 percent of Americans support marijuana legalization—cutting across racial, political, age, and regional demographics. Although federal marijuana policy reform has faced challenges, new efforts are gaining momentum.

**Potential Impact of the STATES 2.0 Act on Marijuana Policy**

The STATES 2.0 Act proposes to defederalize marijuana policy, remove cannabis from the Controlled Substances Act, and allow interstate commerce between states that have legalized marijuana. Discussions on rescheduling marijuana from Schedule I to Schedule III could also have tax implications. Current federal prohibition imposes challenges on “legal” markets, including bans on interstate commerce and difficulties with banking institutions.

**Challenges of Competing with Illicit Marijuana Markets**

Most marijuana consumption still occurs within illicit markets. States imposing high taxes, costly licenses, or other restrictive measures may struggle to curb illicit consumption. Keeping legal market prices competitive is crucial to incentivizing consumers to switch to safer, legal products. Taxes on legalized marijuana should be designed to foster competitiveness with illicit markets. Well-structured taxes could generate billions in state revenue, though it may take time for these markets to develop.

**Future Considerations for Interstate Marijuana Commerce**

While interstate marijuana commerce is currently disallowed, significant differences in state tax designs could lead to challenges if federal policies change. Issues like tax arbitrage and double taxation might emerge. States should work toward harmonizing tax designs now to facilitate smoother transitions when interstate commerce becomes viable.

**Optimizing Marijuana Taxation**

The diversity in marijuana products and potencies complicates taxation. The most effective method is taxing by THC content where measurable or by weight when it’s not. This approach targets the actual harm-causing component and avoids issues like volatile revenues associated with ad valorem taxes. As legal market prices decrease due to increased supply and efficiency, ad valorem tax revenues may diminish over time. Maintaining low tax rates is essential to fostering competition between legal and illicit markets, encouraging safer consumption, and generating taxable income.

Effective taxation policies are crucial as states navigate the evolving landscape of marijuana legalization. By balancing competitive pricing, thoughtful tax design, and potential federal policy changes, states can better position themselves to maximize benefits from legalized marijuana markets.