In a previous article, I discussed the varying impacts of rate cuts on Singapore banks versus Singapore REITs, based on factors like debt structures, property types, and geographic exposure. Today, I will be evaluating five REITs in my portfolio: Frasers Centrepoint Trust, Mapletree Industrial Trust, Mapletree Logistics Trust, Mapletree Pan Asia Commercial Trust, and ParkwayLife REIT.

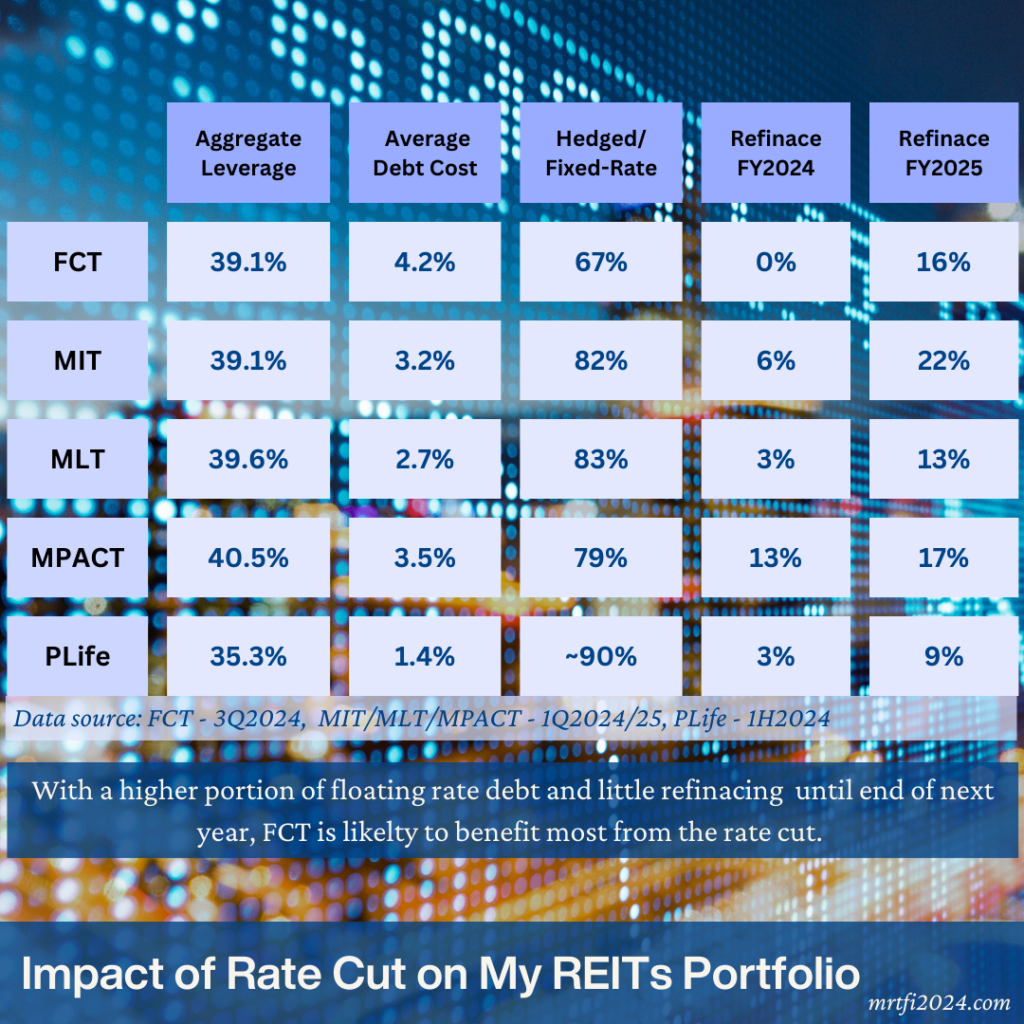

One key factor to consider is the borrowing costs of these REITs. The direct impact of rate cuts affects their average borrowing costs, depending on their proportion of floating-rate debt and the need for refinancing existing debt. For example, FCT stands to benefit the most with a higher proportion of floating-rate debt and no immediate refinancing needs, leading to a quicker realization of lower debt costs.

On the other hand, PLife is less affected by rate cuts due to its loans being predominantly in JPY and extensive hedging. However, potential challenges may arise from rising Japanese interest rates, although gradual increases in debt costs are expected with only 12% of debt to be refinanced by 2025.

The Mapletree REITs present a mixed picture. While lower interest rates may benefit their floating-rate debt, refinancing existing debts at higher rates could offset these gains. The balance between these factors will shape the financial performance of these REITs in the coming years.

In addition to borrowing costs, the demand for REITs is influenced by factors like occupancy rates and rental revisions. Lower interest rates can stimulate economic activities, potentially increasing demand for REIT spaces and improving occupancy rates. However, other factors like government policies and economic conditions also play a significant role in shaping demand for REITs.

For investors interested in REITs for dividend potential and long-term growth, these five REITs still offer attractive yields, with most exceeding returns on Singapore Savings Bonds and T-bills. Despite recent price increases, these REITs remain worth considering for their income-generating potential and resilient performance in the real estate market.

In conclusion, investing in REITs carries inherent risks, including property value fluctuations, interest rate changes, and economic downturns. It is essential to conduct thorough research and risk assessment before investing in REITs to mitigate these risks and make informed financial decisions.