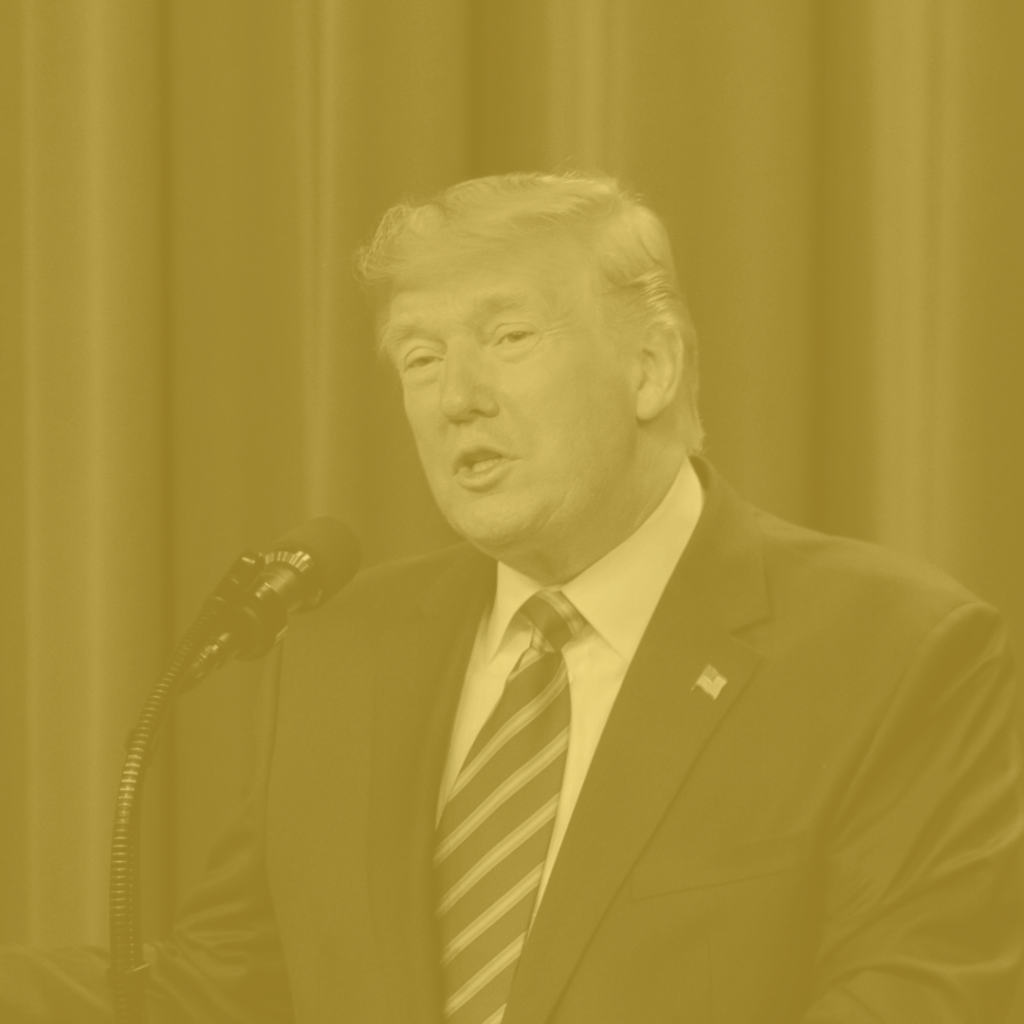

While tax policy was barely mentioned in the first debate between Vice President Kamala Harris and former President Donald Trump, this episode will delve into each candidate’s latest proposals comprehensively. We’ll dissect Kamala Harris’s updated tax plan, focusing on her capital gains adjustments and new deductions for startups. Additionally, we’ll scrutinize Trump’s plans for tax cuts and tariffs, highlighting their potential impact on American families and businesses.

Erica York, Senior Economist and Research Director, joins Kyle Hulehan to discuss the debate. We’ll identify key issues likely to be debated and consider their serious implications for national debt and economic growth.

In-Depth Analyses of Tax Plans

Listen to The Discussion

Tune into the episode on your favorite platform:

Apple Podcasts

Google Podcasts

Spotify

Castbox

Stitcher

Amazon Music

RSS Feed

Stay Updated on Tax Policies Impacting You

Subscribe to receive insights from our trusted experts directly in your inbox.

Share