Exploring Bitcoin Miner Trends for Financial Insights

Bitcoin miners play a crucial role in providing insights into the market sentiment. By analyzing their earnings and actions, we can better understand the potential direction of Bitcoin’s price movements. This article delves into the current trends in Bitcoin mining, explores miner reactions to market conditions, and highlights key indicators that can provide valuable information on how miners are preparing for the future.

Evaluating Miner Earnings

Assessing Bitcoin miner sentiment involves examining their earnings in comparison to historical data. Using tools like The Puell Multiple, which measures current miner earnings against the previous year’s average, can offer valuable insights.

The latest data shows the Puell Multiple around 0.8, indicating miners are earning 80% of the previous year’s average. This marks an improvement from the previous low of 0.53, suggesting a positive outlook for miners despite earlier challenges.

Analyzing Hashrate and Network Growth

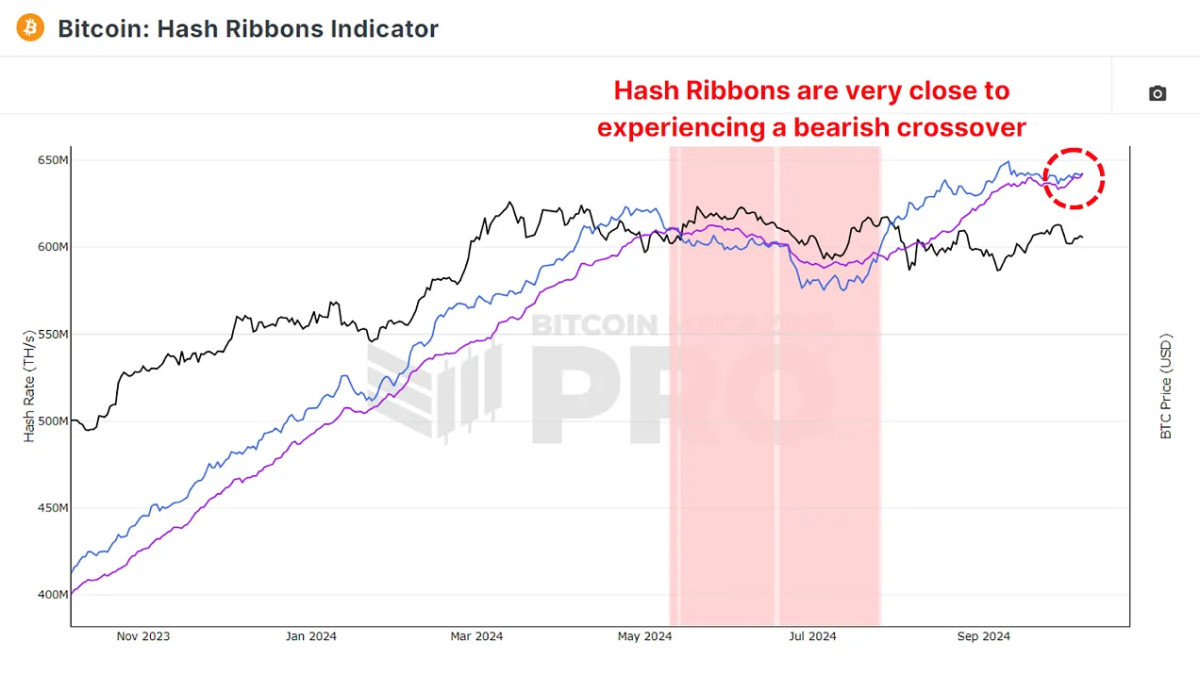

Despite a decrease in earnings, there is a continuous growth in Bitcoin’s hashrate, indicating sustained miner participation and network security. The Hash Ribbons Indicator shows potential bearish signals if the 30-day and 60-day moving averages cross, suggesting a period of miner capitulation.

Despite the potential bearish outlook, past trends indicate accumulation periods following such events, presenting buying opportunities for investors.

Understanding Miner Earnings and Competition

In addition to miner earnings, the Hashprice plays a significant role in miner profitability. Despite reduced earnings post-halving, miners are earning around 0.73 BTC per terahash, showing resilience and optimism for future price appreciation.

The Hashprice Volatility is decreasing, possibly signaling upcoming price movements for Bitcoin.

Final Thoughts on Bitcoin Miner Trends

Bitcoin miners exhibit optimism for BTC’s long-term potential despite current challenges. With growing hashrate, stable earnings, and anticipation of price appreciation, miners are positioning themselves favorably. Decreasing hashprice volatility hints at potential price fluctuations ahead, presenting opportunities for investors.

For more insights, watch our recent YouTube video What Do Bitcoin Miners Expect Next?.